Is there fuel left in Q4 earnings season?

What to look out for today

Companies reporting on Wednesday, 18th February: American Water Works, Booking Holdings, Carvana, CF Industries, DoorDash, Molson Coors Beverage, Moody’s, Occidental Petroleum, Texas Pacific Land

Key data to move markets today

UK: CPI, PPI, PPI Core Output, and Retail Price Index

USA: Durable Goods Orders, Nondefence Capital Goods Orders ex Aircraft, Building Permits, Housing Starts, and FOMC Minutes

US Stock Indices

Dow Jones Industrial Average +0.07%

Nasdaq 100 -0.13%

S&P 500 +0.10%, with 4 of the 11 sectors of the S&P 500 up

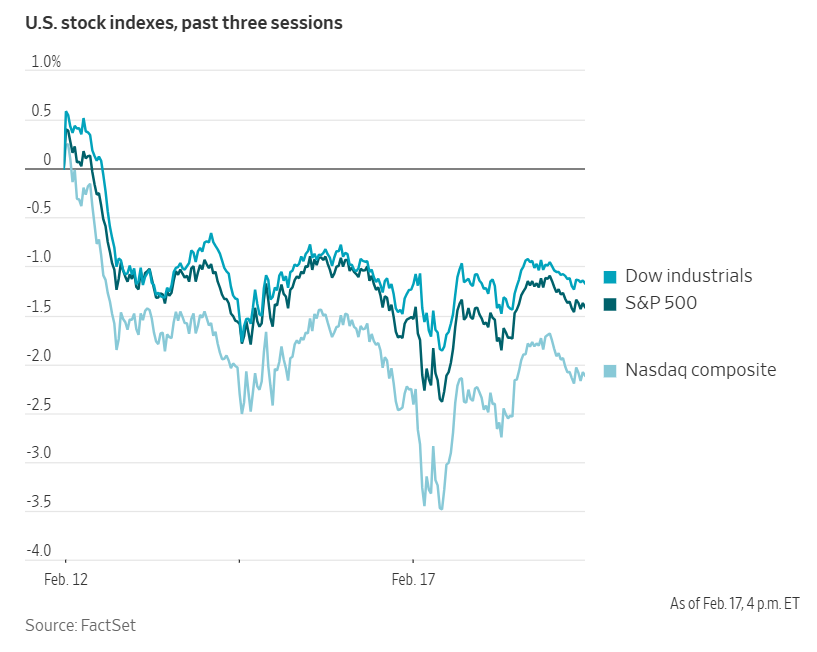

Stock market activity was marked by considerable volatility during intraday trading on Tuesday following the extended holiday weekend. The Nasdaq initially declined over 1% in Tuesday morning trading before rebounding, and all three major indices ultimately posted modest gains.

The Dow Jones Industrial Average rose by 32 points, or +0.07%, to 49,553.19, while the S&P 500 and Nasdaq Composite rose +0.10% and +0.14%, respectively.

In corporate news, Warner Bros. Discovery announced renewed acquisition talks with Paramount Skydance, potentially inciting a bidding contest with Netflix. Paramount may raise its offer to $31 per Warner share if negotiations proceed, while Netflix granted a seven-day waiver for discussions. The Justice Department is reviewing both deals.

Elliott Investment Management acquired over a 10% stake in Norwegian Cruise Line, aiming to drive operational changes.

Jana Partners invested in Fiserv to improve its stock performance and Starboard Value intends to push for board changes at Tripadvisor.

Genuine Parts reported a quarterly loss and plans to split its auto-parts and industrial-parts businesses into separate public companies.

UnitedHealth CEO Stephen Hemsley privately invested in healthcare startups, including those affiliated with UnitedHealth, while adhering to conflict-of-interest policies.

General Mills reduced its annual sales and profit forecast, offering smaller pack sizes to attract health-conscious customers.

Hapag-Lloyd agreed to acquire Zim Integrated Shipping Services for $4.2 billion.

Medtronic reported strong quarterly results without increasing its annual guidance and anticipates a tariff impact of approximately $185 million this fiscal year.

S&P 500 Best performing sector

Real Estate +1.03%, with Alexandria Real Estate Equities +3.66%, Healthpeak Properties +3.11%, and Simon Property +2.63%

S&P 500 Worst performing sector

Energy -1.37%, with ConocoPhillips -2.38%, APA -2.08%, and Baker Hughes -1.82%

Mega Caps

Alphabet -1.05%, Amazon +1.19%, Apple +3.17%, Meta Platforms -0.08%, Microsoft -1.11%, Nvidia +1.20%, and Tesla -1.63%

Information Technology

Best performer: Enphase Energy +4.94%

Worst performer: Cadence Design Systems -5.34%

Materials and Mining

Best performer: Ecolab +1.55%

Worst performer: Vulcan Materials -7.76%

Corporate Earnings Reports

Posted on Tuesday, 17th February

Devon Energy quarterly revenue -6.4% to $4.121 bn vs $3.990 bn estimate

EPS at $0.82 vs $0.80 estimate

Clay Gaspar, President and CEO, said, “Devon’s disciplined execution and operational excellence defined 2025, culminating in outstanding results that exceeded fourth-quarter expectations across all major value drivers. The success we achieved this year was underpinned by the momentum generated through our focused business optimization efforts, resulting in significant free cash flow and meaningful cash returns to shareholders. In addition to our banner year in 2025, we have taken bold, strategic steps to significantly strengthen our portfolio and position ourselves for sustained success through a transformative merger with Coterra Energy. This powerful combination brings together two industry-leading companies with complementary assets and proven track records of value creation, establishing a premier independent shale operator. This advantaged platform will deliver higher free cash flow and enhanced shareholder returns, well beyond what either company could achieve on its own.” — see report.

Kenvue quarterly revenue +3.2% to $3.780 bn vs $3.676 bn estimate

EPS at $0.27 vs $0.22 estimate

Kirk Perry, CEO, said, “We ended 2025 with stronger top- and bottom-line performance in the fourth quarter, which reflected both disciplined execution against our strategic priorities, as well as a more favorable year-ago comparison on sales. As we look to 2026, we remain focused on continuing to enhance our performance, while progressing toward completion of our value-creating combination with Kimberly-Clark.” — see report.

Palo Alto Networks quarterly revenue +14.9% to $2.594 bn vs $2.582 bn estimate

EPS at $1.03 vs $1.02 estimate

Nikesh Arora, Chairman and CEO, said, “We saw continued strength in platformizations, a trend that is accelerating due to AI - customers are keen to both modernize and normalize their cybersecurity stack, aligning them to our approach. We also saw steady and strong adoption of AI security, which we expect will be a long term trend. We are excited to welcome the employees of Chronosphere and CyberArk to help us drive our growth in the future." — see report.

European Stock Indices

CAC 40 +0.54%

DAX +0.80%

FTSE 100 +0.79%

Commodities

Gold spot -2.58% to $4,878.03 an ounce

Silver spot -4.01% to $73.51 an ounce

West Texas Intermediate -2.27% to $62.30 a barrel

Brent crude -1.88% to $67.38 a barrel

Spot gold fell -2.58% to $4,878.03 per ounce on Tuesday as progress in the US-Iran talks reduced safe-haven demand. In addition, Ukraine and Russia began two days of US-mediated peace talks in Geneva. A stronger US dollar further weighed on prices.

Many Asian markets, including China, Hong Kong, Taiwan, South Korea, and Singapore, were closed for the Lunar New Year.

Spot silver fell -4.01% to $73.51 per ounce, after reaching a low of $71.92.

Oil prices dropped to a two-week low on Tuesday, reflecting optimism that tensions between the US and Iran are easing. Brent crude settled at $67.38 per barrel, down $1.29 or -1.88%. US WTI crude closed at $62.30, falling $1.45 or -2.27%. These figures marked the lowest closes for Brent since 3rd February and for WTI since 2nd February.

Tehran and Washington reached an understanding on key principles during a second round of indirect nuclear talks in Geneva. However, Iranian Foreign Minister Abbas Araqchi cautioned that an agreement is not imminent. The negotiations occurred amid a US military buildup in the Middle East. Iran's supreme leader warned against any US attempt to overthrow his government.

Additionally, Iranian state media reported that Iran temporarily closed the Strait of Hormuz — one of the world’s most critical oil export routes — though it was unclear whether the waterway had fully reopened. Investors remain alert to developments in US-Iran relations, as further conflict may prompt Iran to shut the Strait again.

In Geneva, Ukraine and Russia completed the first day of US-mediated peace talks, with President Trump urging Ukraine to expedite efforts toward a resolution. Any peace agreement could potentially result in the lifting of sanctions on Russia, allowing Russian oil to return to global markets. Ukraine continued attacks on Russian energy infrastructure, striking the Ilsky refinery and reporting a drone attack at the port of Taman on Tuesday.

Note: As of 4 pm EST 17 February 2026

Currencies

EUR +0.03% to $1.1853

GBP -0.43% to $1.3567

Bitcoin -1.73% to $67,652.97

Ethereum +0.01% to $1,999.24

On Tuesday, the US dollar edged higher against major currencies with the dollar index advancing +0.02% to 97.11, its second consecutive session of gains.

The dollar increased +0.08% to 0.7010 Swiss francs, while the euro was marginally higher by +0.03% at $1.1853. Sterling weakened -0.43% to $1.3567 after UK data revealed that unemployment rose to a five-year high in December, alongside slower wage growth. This supports expectations for further BoE rate cuts with the first cut more likely to take place this spring.

The Japanese yen rose +0.15% to ¥153.28 per dollar, regaining ground following earlier losses, as momentum continued after Prime Minister Sanae Takaichi’s election victory.

Fixed Income

US Bond +1.2 basis points to 4.064%

German 10-year -1.8 basis points to 2.740%

UK 10-year gilt -1.9 basis points to 4.383%

US Treasury yields rebounded from multi-month lows on Tuesday as market participants assessed potential Fed policy shifts in the absence of significant new drivers.

Following last week’s data showing strong job gains and easing inflation, traders have increased expectations that the Fed will maintain current rates over the next few months.

Tuesday’s Fedspeak showcased the policymakers different opinions and focuses. Fed Governor Michael Barr suggested that any further rate cuts by the FOMC are likely to be delayed due to ongoing inflation risks. However, Chicago Fed President Austan Goolsbee indicated that additional cuts may be considered if inflation moves toward the central bank’s 2% target. San Francisco Fed President Mary Daly emphasised the need to closely analyse data to determine whether advances in AI are enhancing productivity and economic growth without fuelling inflation.

The 2-year Treasury yield, which is sensitive to Fed policy expectations, rose +3.3 bps to 3.451% after hitting a low of 3.385%, its lowest since 17th October. The 10-year yield increased +1.2 bps to 4.064%, after reaching a low of 4.018%, the lowest since 28th November. The yield curve between the 2- and 10-year notes flattened by 2.1 bps to 61.3 bps. The 30-year yield edged down -0.3 bps to 4.693%.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 59.1 bps of cuts in 2026, slightly lower than the 59.2 bps priced in the previous week. Fed funds futures traders are now pricing in a 7.9% probability of a 25 bps rate cut at the 18th March FOMC meeting, down from 20.1% a week ago.

Eurozone government bond yields fell to their lowest levels since early December, extending a six-day decline.

Germany’s 10-year Bund yield fell for a seventh consecutive session on Tuesday, easing -1.8 bps to 2.740%, its lowest level since early December, as safe-haven demand persisted amid expectations of a potential additional ECB rate cut this year.

German yields tracked broader European markets, as recent eurozone data had minimal impact. While the ZEW economic research institute reported a surprise drop in German investor sentiment for February, the outlook for the current economic situation improved.

Across the curve, the German 2-year yield slipped -1.0 bps to 2.038%, and the 30-year yield declined -2.9 bps to 3.405%.

Other eurozone bonds moved in tandem, with France’s 10-year yield down -1.7 bps to 3.327% and Italy’s falling -1.4 bps to 3.357%.

Note: As of 5 pm EST 17 February 2026

Global Macro Updates

UK CPI. The UK’s January Consumer Price Index (CPI) was released early today, with headline inflation coming in at the forecast 3.0% y/o/y from the previous 3.4% and slightly above the 2.9% forecast by the BoE. Core inflation came in higher than projected, at 3.1% vs the 2.9% forecast by the BoE. Services inflation fell to 4.4%, slightly above economists’ expectations of 4.3% and the BoE’s predicted 4.1%. It was down compared to 4.5% in December. It is the lowest level since 2021. This deceleration is largely attributed to seasonal discounting and favourable base effects, with post-Christmas price reductions exerting downward pressure on core goods. Goods inflation fell steeply to 1.6% from 2.2%. Falling petrol prices, airfares and food also put downward pressure on CPI.

The primary focus, however, remains on the momentum within services inflation. The drop reinforces the disinflation narrative and supports the view that domestic price pressures are subsiding in line with slowing wage growth. This aligns with the BoE’s projection for inflation to return to target in Q2, further supported by government cost-of-living initiatives and regulatory changes to prices. Some economists foresee a temporary dip below the 2% target before inflation strengthens again later in the year as base effects diminish. Following the data release traders are pricing in two 25 bps cuts this year, with a 75% chance of a rate cut at the BoE’s meeting in March.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Ten artykuł jest publikowany wyłącznie w celach informacyjnych i nie powinien być traktowany jako oferta lub zachęta do kupna lub sprzedaży jakichkolwiek inwestycji lub powiązanych usług, do których można się tu odwołać. Obrót instrumentami finansowymi wiąże się ze znacznym ryzykiem strat i może nie być odpowiedni dla wszystkich inwestorów. Wyniki osiągnięte w przeszłości nie są wiarygodnym wskaźnikiem wyników w przyszłości.

Zarejestruj się i otrzymuj informacje rynkowe

Zarejestruj się i otrzymuj

informacje

rynkowe

Subskrybuj teraz