Is the US in geopolitical self-destruct mode?

Markets in January

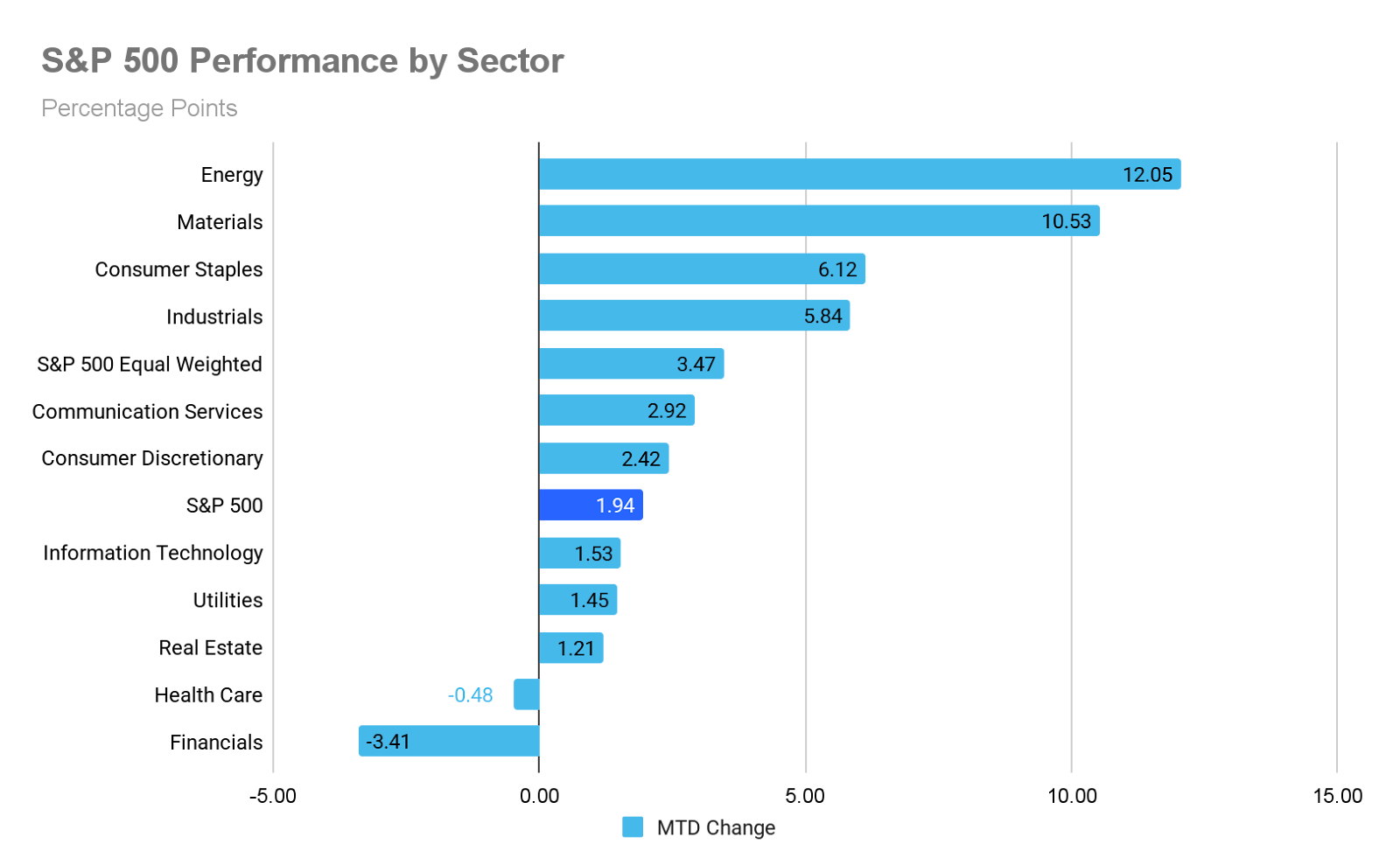

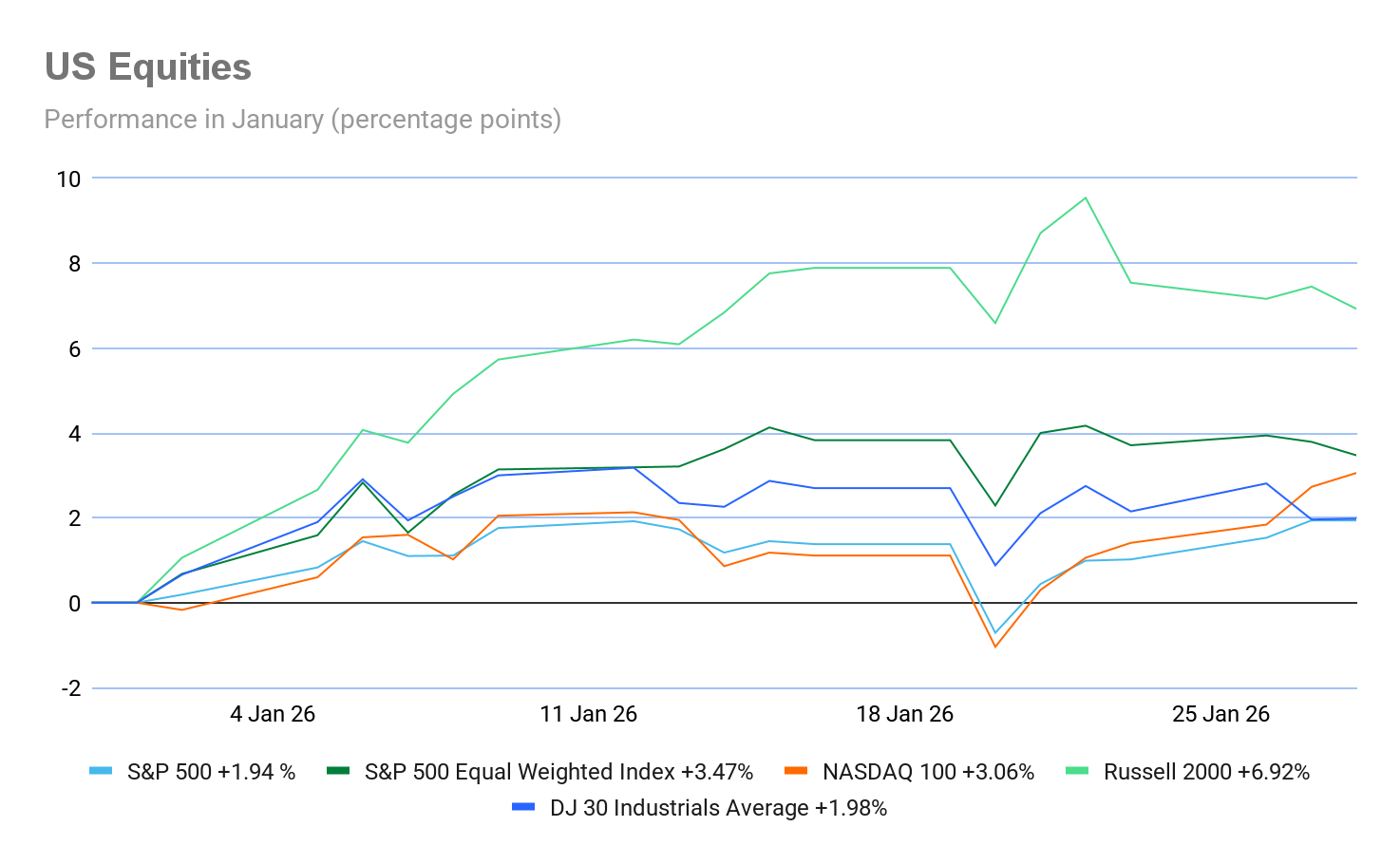

January has seen US equity markets continue to rise with the S&P 500 topping the 7,000 mark for the first time on Wednesday, 28th January. Major US indices have shown a month-to-date (MTD) performance: S&P 500 +1.94%, Nasdaq 100 +3.06%, Dow Jones +1.98%, and Russell 2000 +6.92%.

US bond markets have absorbed geopolitical and tariff-related volatility and rallied. Strong investor demand supported bonds before Wednesday's Fed meeting. Although bond yield steepening is expected again this year, it looks like the 10-year Treasury yield should hold near 4% due to sticky inflation, the expected increase in Treasury supply to finance federal deficits and rising global bond yields.

The economic picture

USA. Markets have been swayed this month by the rise in geopolitical risk stemming from President Trump’s threats to Greenland and the EU, his administration’s virtual take-over of Venezuela and military threats to other Latin American countries such as Colombia and Cuba, and warnings to Iran that a US attack will be greater than the US strikes on three Iranian nuclear facilities last June if they do not strike a deal on Iran’s nuclear programme or end its crackdown on anti-regime protests that have been estimated to kill 30,000 people. There has also been significant domestic political risk rising following on from the death of two US citizens by US ICE border force agents, resulting in Senate Democrats threatening to pull approval on a six-bill spending package if Department of Homeland Security (DHS) funding is not separated out. This would cause a partial government shutdown from this Saturday.

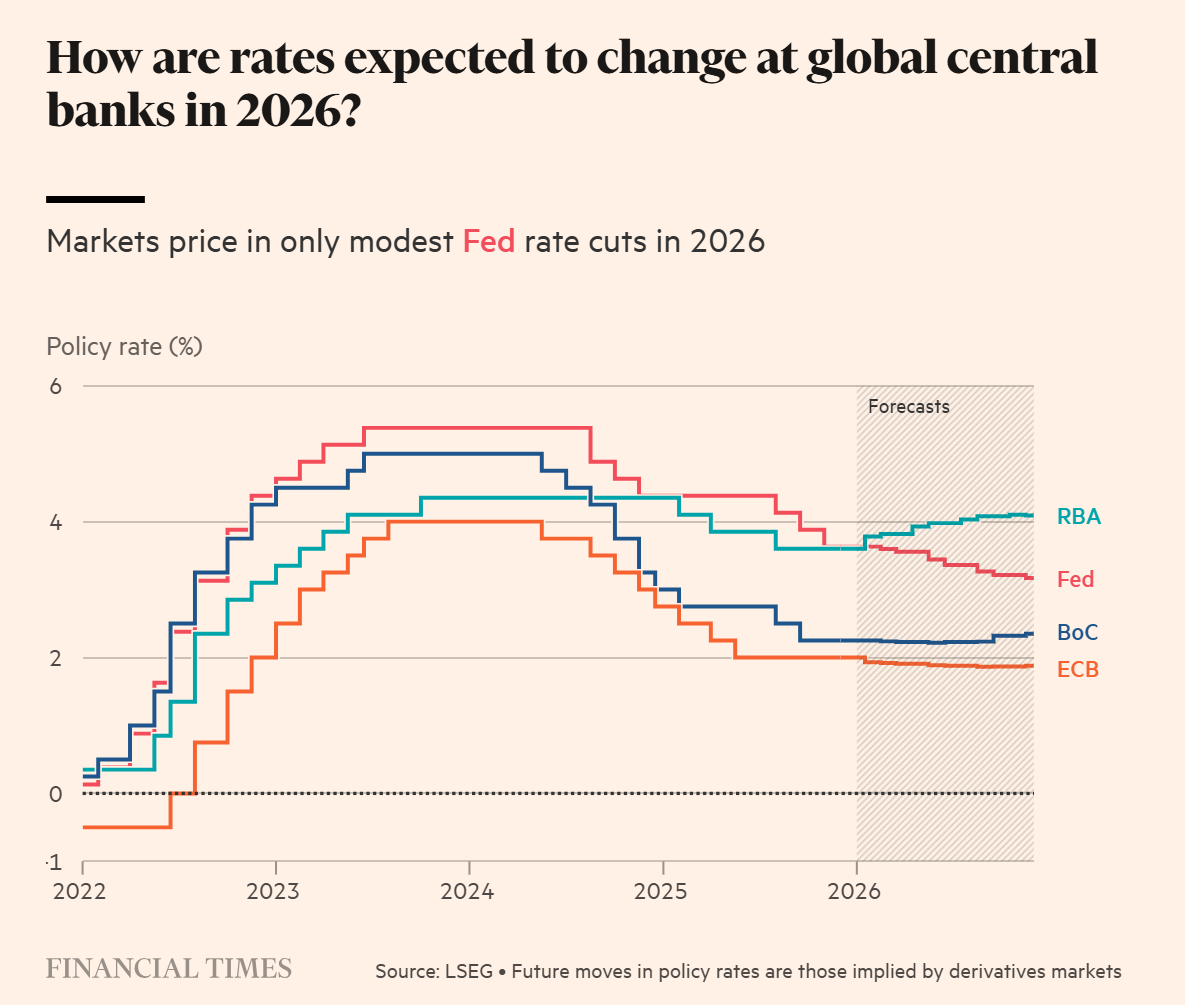

The FOMC January meeting resulted in a widely anticipated rate hold at 3.50-3.75%, with 2 members dissenting. The statement took on a more hawkish tone as it upgraded economic activity to "solid," and said job gains have remained low with the unemployment rate showing signs of stabilisation. Officials dropped language pointing to increased downside risks to employment that had appeared in the three previous statements. The Fed statement noted inflation remains somewhat elevated.

US economic data has been mixed this month although the Atlanta Fed’s GDPNow indicator, which tracks the latest economic data, currently projects growth of 5.4 per cent for the fourth quarter. Real gross domestic product (GDP) increased at an annual rate of 4.4 percent in the third quarter of 2025 (July, August, and September), according to the updated estimate released by the US Bureau of Economic Analysis. In the second quarter, real GDP increased 3.8 percent. However, the ISM Manufacturing Index fell for a third consecutive month to 47.9 in December 2025, the lowest level since October 2024, compared to 48.2 in November and forecasts of 48.3. Nevertheless, business activity has ticked higher in January. The January Flash S&P PMI composite reading edged very slightly up, coming in at 52.8 from December’s 52.7. Manufacturing growth accelerated to outpace that of services, but the January survey showed signs that underlying order book growth has softened in both sectors. The Flash US Services PMI came in at 52.5, unchanged from December’s 52.5, while the Flash Manufacturing PMI moved slightly up to 51.9 from December’s 51.8. As noted by Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, "The flash PMI brought news of sustained economic growth at the start of the year, but there are further signs that the rate of expansion has cooled over the turn of the new year compared to the hotter pace indicated back in the fall.” He also said that increased costs, widely blamed on tariffs, were cited as a key driver of higher prices for both goods and services in January, meaning inflation and affordability remains a concern for businesses.

On the consumer side, confidence weakened to its lowest level since 2014. The Consumer Confidence Index fell by 9.7 points in January to 84.5 from an upwardly revised 94.2 in December. A 5.1-point upward revision to December’s reading of the Index resulted in a slight increase last month, reversing the initially reported decline. The Present Situation Index, based on consumers’ assessment of current business and labour market conditions, declined 9.9 points to 113.7 in January, the lowest in nearly five years. The Expectations Index, based on consumers’ short-term outlook for income, business, and labour market conditions, fell by 9.5 points to 65.1, the lowest since last April. In contrast, the January US consumer sentiment reading from the University of Michigan saw consumer sentiment improving, with minor gains seen across all index components. The Consumer Sentiment Index rose to 56.4 from 52.9 in December. The Current Index rose to 55.4, up from 50.4 in December, and the Expectations Index rose to 57.0, up from 54.6 in December.

Inflation, as measured by the Consumer Price Index (CPI), increased 0.3 percent on a seasonally adjusted basis in December and 2.7% over the past 12 months, the same as the 12 months ending November. Core CPI rose 0.2 percent in December and 2.6 percent over the last 12 months. The PCE price index increased 0.2 percent in both October and November. The core PCE price index, excluding food and energy, also increased 0.2 percent in both months.

On the labour front, data revealed weakness amid business uncertainty. Nonfarm payroll employment came in at +50,000 and the unemployment rate at 4.4 percent. Private payrolls increased by 37,000, just a fraction of what was seen in the same month a year earlier. October and November payrolls were revised lower by 76,000. For the full year, payrolls climbed by 584,000, making it the weakest increase since 2020.

EU. Eurozone headline inflation in December was 1.9% y/o/y, down from November’s 2.1%. Core inflation eased to a four-month low of 2.3% year-on-year, down from 2.4% in November. Services prices came in at 3.4%, compared with 3.5% in November, while food, alcohol & tobacco came in at 2.5%, compared with 2.4 % in November, and energy continued to fall, coming in at -1.9% compared with -0.5% in November.

The European Commission's consumer confidence index increased by 0.8 percentage points in the euro area, coming in at -12.4 points, but remained below its long-term average.

Eurostate estimates that the euro area economy grew by 0.3% in the third quarter of 2025. As noted in the latest ECB bulletin, growth was driven by domestic demand and inventory accumulation, while net trade contributed negatively, owing to strong import growth, particularly in Ireland. The rise in intangible investments and detailed services production data suggest that AI-related expenditure is increasing. Growth in gross value added in the third quarter was driven by market services, led by the information and communications sector, while the contributions from industry and construction were flat. In January eurozone business activity has been growing, but weak. There was an increase of new orders, while optimism in the outlook hit a 20-month high. However, on a less positive note, companies reduced their staffing levels for the first time in four months amid marked job cuts in Germany. The HCOB Flash Composite PMI was unchanged at 51.5. The HCOB Flash Manufacturing PMI edged only slightly up and still stuck in contractionary territory, coming in at 49.4 from December’s 48.8. The HCOB Flash Services PMI fell in January, coming in at 51.9, down from December’s 52.4 and reaching a 4-month low.

UK. The UK’s economy is showing some conflicting signals with the Office for National Statistics figures suggesting that GDP grew by only 0.1%, after showing no growth in the three months to October 2025. However, the January S&P Flash business activity surveys show some possible signs of hope. The UK S&P Global Composite PMI rose to 53.9 in January of 2026 from 51.4 in the previous month, well above market expectations of 51.5 to mark the sharpest growth in the UK private-sector activity since April of 2024. The Flash Services PMI rose to 54.3 from December’s 51.4, a 21-month high. The Flash Manufacturing PMI came in at 51.6, up from December’s 50.6 and a 17-month high. As noted by Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, “While growth continues to be driven by the service sector, and in particular financial services and tech, the manufacturing sector is also continuing to report a gathering recovery aided by resurgent demand, with goods exports notably rising for the first time in four years.” He also noted that the upturn in order books failed to stem steep job losses, which companies blamed on cost pressures linked to government policies relating to higher National Insurance contributions and the National Minimum Wage.

Retail sales in the UK rose in December with the total volume of goods sold online and in stores rising 0.4%, with the volume of goods sold online rising 4.2%, boosted by jewellery and food. However, across the Q4 as a whole, retail volumes declined 0.3% due to a slowdown in supermarket sales. The GfK consumer confidence index was up one point to -16 in January, marking 10 years since consumer confidence was last in positive territory. The Personal Financial Situation, measuring changes in personal finances over the last 12 months, increased by three points to -3. The General Economic Situation, the measure for the country’s general economic situation over the last 12 months, decreased by five points to -45, while expectations for the general economic situation over the next 12 months were down two points to -31.

Inflation in the UK remains above the BoE target. Headline CPI came in at 3.4% in the 12 months to December 2025, up from 3.2% in November, driven largely by increased tobacco duties and air fares. It was 0.4% on a monthly basis. Core inflation came in at 3.2% in the 12 months to December 2025, the same rate as November. Services inflation was 4.5% in December 2025, up from 4.4% in November.

Global market indices

USA:

S&P 500 +1.94% MTD

Nasdaq 100 +3.06% MTD

Dow Jones Industrial Average +1.98% MTD

NYSE Composite +3.62% MTD

Source: FactSet

The Equally Weighted version of the S&P 500 is +3.47% MTD for January, 1.53 percentage points higher than the benchmark.

The S&P 500 Energy sector is the top performer thus far in January at +12.05% MTD, while Financials underperformed at -3.41% MTD.

On Wednesday, major US equity indices were largely steady. The Nasdaq Composite gained

40.35 points, or +0.17%, to 23,857.45. The S&P 500 lost 57 points, or -0.01% to 6,978.03; it had briefly topped the 7,000 points milestone for the first time earlier in the day. The Dow Jones Industrial Average was up 12.19 points or +0.02% to 49,015.60.

In corporate news, Samsung’s chip unit surpassed expectations with a more than five-fold profit gain in the December quarter, boosted by an artificial intelligence boom, and announced a $2.5 billion buyback.

Seagate Technology shares rose over 19% after forecasting third-quarter revenue and profit above Wall Street expectations.

Amazon said it is cutting 16,000 corporate jobs to remove layers of bureaucracy and “increase ownership.” It said Tuesday it was closing its remaining brick-and-mortar Fresh grocery stores and Go markets.

Home Depot said it was cutting jobs across several teams and requiring corporate staff to return to the office as it contends with a slowdown caused by the frozen housing market.

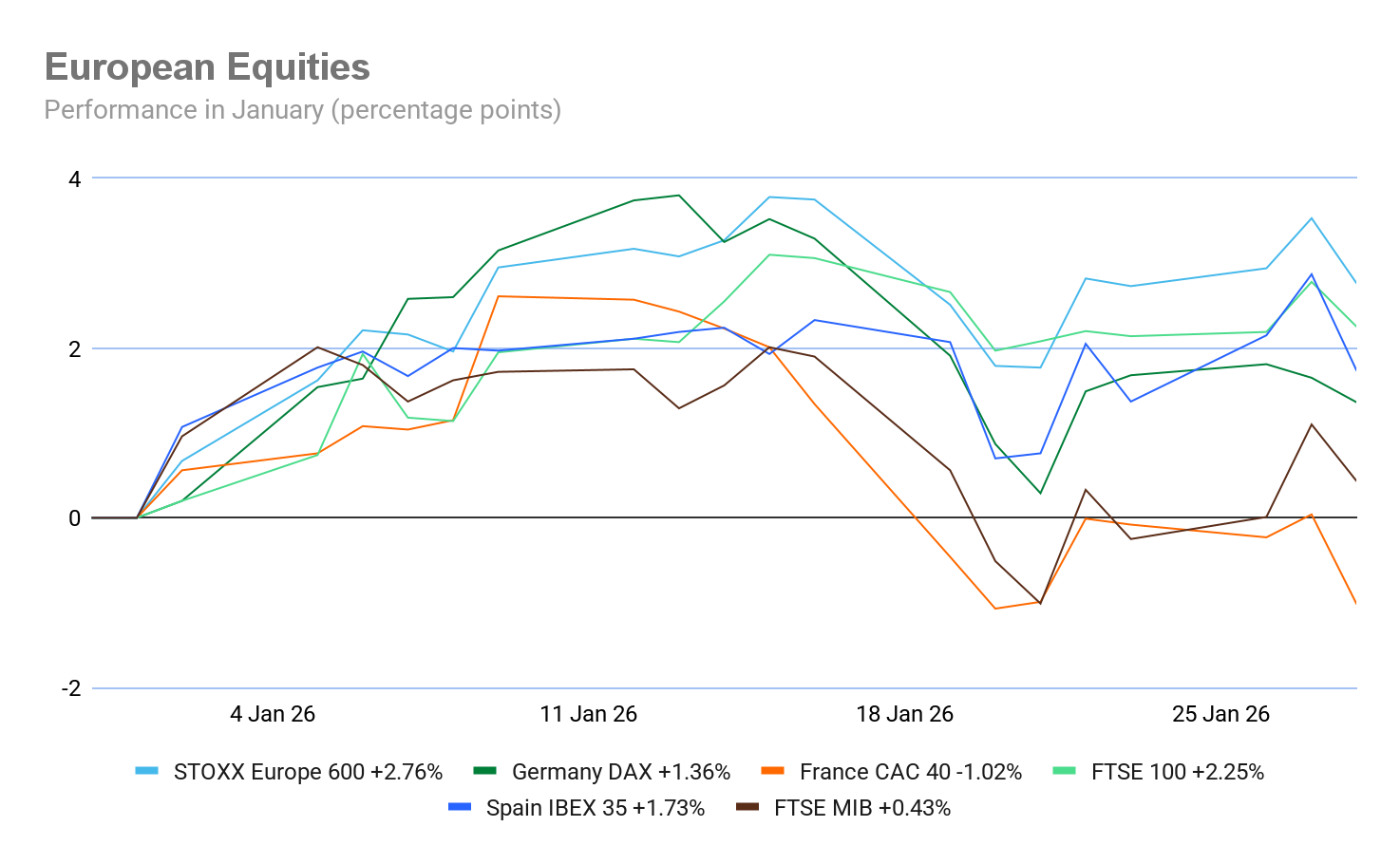

Europe:

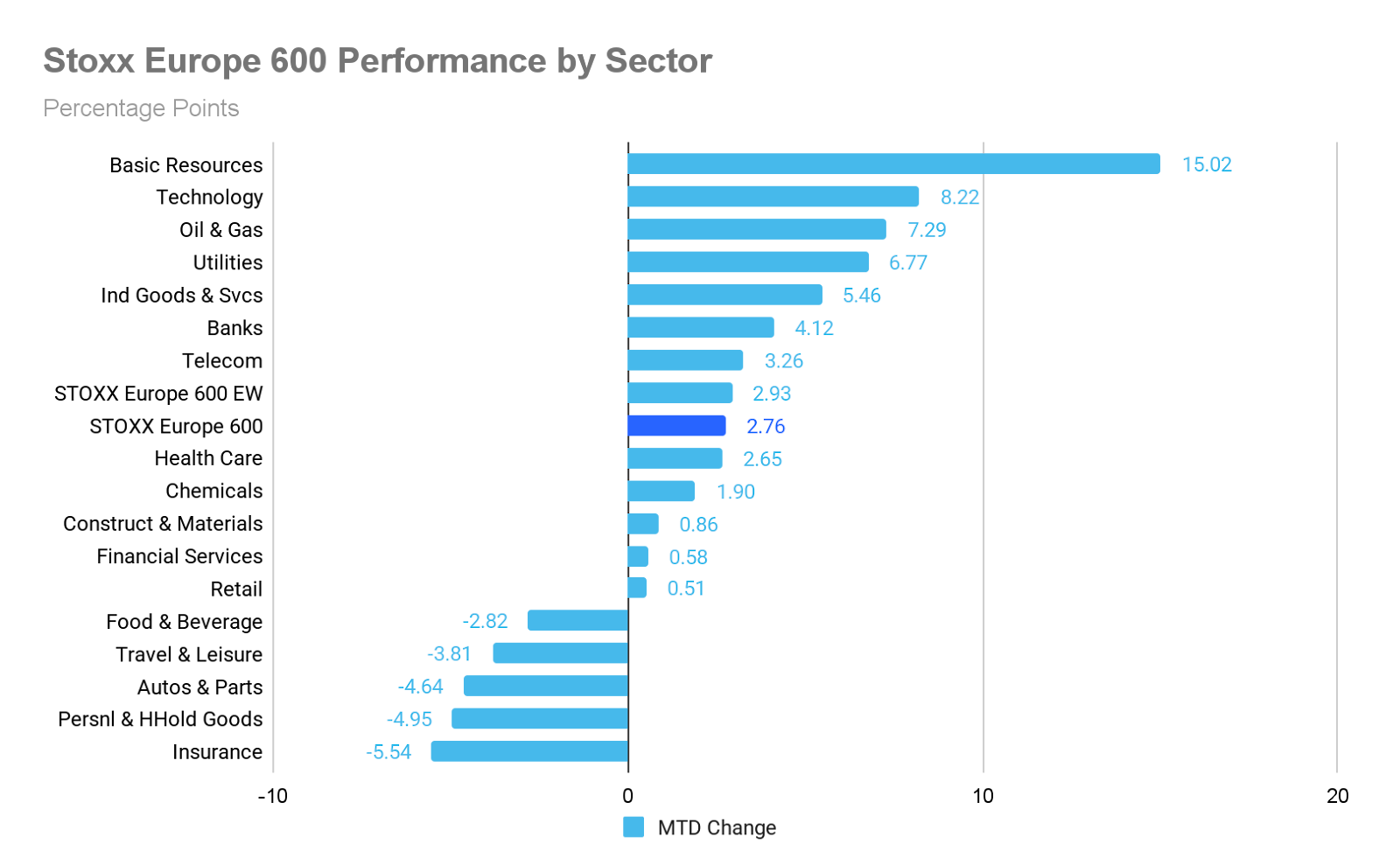

Stoxx 600 +2.76% MTD

DAX +1.36% MTD

CAC 40 -1.02% MTD

FTSE 100 +0.43% MTD

IBEX 35 +1.73% MTD

FTSE MIB +1.10% MTD

Source: FactSet

In Europe, the Equally Weighted version of the Stoxx 600 is +2.93% MTD, 0.17 percentage points higher than the benchmark.

The Stoxx 600 Basic Resources is the leading sector, +15.02% MTD, while Insurance exhibited the weakest performance at -5.54% MTD.

On Wednesday, European equity markets closed lower, nearing their worst levels of the session. The CAC 40 index lagged behind, driven by notable weakness in luxury goods sectors. The Healthcare, Personal and Household goods, Banking, and Telecommunications industries were the largest underperformers, while Technology, Energy, and Real Estate sectors showed relative strength. This follows a generally positive performance on Tuesday, with the Stoxx Europe 600 index rising +1.7% for the week.

On the corporate front, ASML Holding reported Q4 net bookings of €13.16 billion, significantly surpassing the forecast of €7.18 billion. Volvo Group posted Q4 EBIT of SEK 12.77 billion, exceeding market expectations. Meanwhile, LVMH Moët Hennessy Louis Vuitton's Q4 results disappointed investors due to weaker margins, despite achieving sales growth in China. Royal KPN recorded Q4 net income of €240 million, slightly below analyst forecasts.

Global:

MSCI World Index +2.94% MTD

Hang Seng +8.57% MTD

Mega cap stocks have had a mixed performance so far in January. Alphabet +7.35%, Apple -5.67%, Meta Platforms +1.31%, Amazon +5.28%, Microsoft -0.41%, Tesla -4.06%, and Nvidia +2.69%.

On Wednesday Meta Platforms reported its Q4 2025 corporate earnings. It reported an EPS of $8.88 on revenue of $59.9 billion vs. the $8.16 and $58.4 billion estimate. It boosted its capital spending plans by 73% in the pursuit of "superintelligence," an effort to offer deeply personalised artificial intelligence to its large social media user base. The company posted a 24% surge in advertising revenue. However, it said its Reality Labs unit recorded an operating loss of $6.02 billion on $955 million in sales. The company said it expects its capital expenditure for 2026 to be between $115 billion and $135 billion, driven largely by infrastructure costs including payments made to third-party cloud providers, higher depreciation of its AI data centre assets, and higher infrastructure operating expenses. Meta forecast 2026 total expenses to be in the range of $162 billion and $169 billion, up from $117.69 billion a year ago, driven by rising employee compensation.

Tesla’s Q4 reported corporate earnings showed an adjusted EPS of 50 cents vs 45 cents estimated and revenue of $24.90 billion vs $24.79 billion estimated. Revenue in the fourth quarter slid 3% from $25.7 billion a year earlier, with the auto segment falling 11% to $17.7 billion from $19.8 billion. The revealed plans to invest $2 billion into CEO Elon Musk’s artificial intelligence company, xAI and that production plans for its Cybercab robotaxi were on track for this year. In the company’s earnings call on Wednesday, Musk said Tesla would put an end to production of its Model S and X vehicles and that the company plans to convert the factory lines where it had produced the Model S and X in Fremont, California, to lines that will make the forthcoming Optimus humanoid robots. Chief Financial Officer Vaibhav Taneja said plans to build Cybercabs and humanoid robots, Semi trucks and Roadster sports cars will mean a series of factory investments that will take capital expenditures above $20 billion this year.

Microsoft shares fell 7% in late trading on Wednesday as investors were shaken by the 66% rise in data centre spending and slower than expected cloud growth, despite strong demand for AI services boosting profits. The company reported an adjusted EPS of $4.14 adjusted vs $3.97 expected and revenue totalling $81.27 billion vs $80.27 billion expected. Adjusted net income beat expectations, rising 23% y/o/y year to $30.9bn in the three months to the end of December. For the fiscal second quarter, revenue from Azure and other cloud services grew 39%, compared with 40% growth in the fiscal first quarter. Microsoft’s Intelligent Cloud segment that includes Azure cloud infrastructure produced $32.91 billion in revenue, up nearly 29%. But Microsoft’s capital expenditure, including finance leases, was $37.5bn in the quarter, an increase from $34.9bn in the prior three months and 66% higher than the year before.

Energy stocks experienced a largely positive performance so far in January with the Energy sector +12.05% MTD. Energy Fuels +88.88%, Halliburton +18.05%, Baker Hughes Company +24.35%, Marathon Petroleum +5.77%, Apa Corp +6.34%, Phillips 66 +10.11%, Occidental Petroleum +9.02%, ExxonMobil +14.33%, Chevron +18.50%, and ConocoPhillips +8.31%, while Shell -0.27%.

Materials and Mining stocks have had a very positive performance so far in January. The Materials sector is +10.53% MTD. CF Industries Holdings +20.47%, Mosaic +16.81%, Albemarle +30.32%, Sibanye Stillwater +35.92%, Newmont Mining +32.15%, Nucor Corporation +6.17%, Celanese Corporation +9.20%, Freeport-McMoRan +25.28%, and Yara International +6.28%.

Commodities

Gold prices continued to rise Wednesday with the market showing little reaction to the Fed’s decision to leave rates unchanged. Spot gold was +4.36% to $5,301.60 per ounce by 5 pm EST. US gold futures for February settled 4.3% higher at $5,303.60.

Gold is considered a safe-haven asset and typically performs well during periods of low rates.

It has gained +22.56% since the start of the year, building on last year's record gains of around +65%. It has risen through January due to rising geopolitical risks, namely US military actions in Venezuela, potential escalations in the Arctic and threats to Greenland and European trade, renewed US-Iran friction, and tariffs on South Korean imports. It has also been supported by a weaker dollar, anticipated Fed rate cuts, and de-dollarisation trends by central banks.

Spot silver was +10.22% by 5 pm on Wednesday to $116.82 an ounce after hitting a record high of $117.69 on Monday. It is +65.42% this year.

Oil prices rose Wednesday to their highest since September. Brent crude futures settled up 83 cents, or 1.23%, to $68.40 a barrel. US WTI crude closed 82 cents, or 1.31%, higher at $63.21.

Prices were supported by a surprise storage drawdown with the US Energy Information Administration saying that the country's crude oil inventories had dropped unexpectedly due to the severe winter storms the US has been experiencing. Rising geopolitical concerns also raised prices as President Trump threatened Iran with an attack worse than last June’s if Iran did not make a deal on nuclear weapons.

Both benchmarks were headed for their biggest monthly rises in percentage terms since July 2023, with Brent up around 11% and WTI around 10%.

EIA report. According to the EIA’s report released Wednesday, US crude oil inventories fell in the week ended 23rd January by 2.3 million barrels to 423.8 million barrels after jumping by 3.6 million barrels in the previous week. US crude oil inventories are about 3 percent below the five-year average for this time of year. Crude stocks at the Cushing, Oklahoma, delivery hub fell 278,000 barrels in the week, the EIA said. This can be attributed to a severe winter storm that has been sweeping across much of the US, straining energy infrastructure and power grids.

Last weekend, oil and liquefied natural gas exports from the US Gulf Coast ground to a halt due to icy temperatures, according to ship-tracking service Vortexa. Refinery crude runs fell by 395,000 bpd, while utilisation rates fell by 2.4 percentage points in the week to 90.9% amid ongoing maintenance and as some refiners faced operational challenges due to the frigid weather.

However, US crude exports rose by 901,000 barrels per day to 4.59 million bpd last week, while net US crude imports fell by 1.71 million barrels per day.

Gasoline demand jumped by 923,000 bpd to 8.76 million bpd, while distillate demand was up 544,000 bpd to 4.07 million bpd. Despite this, gasoline inventories edged up by 0.2 million barrels last week to 257.2 million barrels and are about 5 percent above the five-year average for this time of year.

Distillate inventories, which include diesel and heating oil, rose by 330,000 barrels last week to 132.9 million barrels versus expectations for a 580.000 drop. They are about 1 percent above the five-year average for this time of year, the EIA said.

Currencies

On Wednesday, the dollar gained against the euro and the yen after the Federal Reserve kept interest rates steady, citing still-elevated inflation alongside solid economic growth.

The euro was -0.71% to $1.1955 on Wednesday after topping the $1.20 for the first time since 2021. The British pound was -0.33% to $1.3802 after hitting 4-1/2- year highs on Tuesday.

The greenback was +0.80% against the yen at 153.42. The yen remains a focal point for investors, who are vigilant for signs of official Japanese intervention to counter the currency’s ongoing weakness. The yen is set for its strongest monthly performance against the dollar since

April.

The dollar index rose +0.14% to 96.35. The dollar rebounded earlier in the session after Treasury Secretary Scott Bessent reaffirmed the United States' preference for a strong dollar, saying “The United States has a strong dollar policy and that means setting the right fundamentals”, while denying that the US was intervening in currency markets to support the Japanese yen. The dollar has been under pressure due to several factors: expectations of continued rate cuts, tariff uncertainty, policy volatility including threats to Fed independence and rising fiscal deficits.

The index had fallen as low as 95.86 on Tuesday, its weakest since February 2022, after President Donald Trump brushed off this month's slide, saying a lower dollar was “great”.

The US dollar index is -2.01% so far in January. The GBP is +2.44% against the dollar MTD and the EUR is +1.77% MTD against the USD.

Cryptocurrencies

Bitcoin +1.79% MTD to $89,304.10

Ethereum +1.60% MTD to $3,019.00

Bitcoin was -0.03% and Ethereum was -0.18% on Wednesday.

Cryptocurrencies have risen thus far in January but Bitcoin price action seems to have cooled on short-term profit-taking although the macro environment is slowly improving. Nevertheless, Bitcoin’s underperformance over the past three months have erased all of Bitcoin’s 2026 gains, leaving it about 30% below its October 2025 peak of $120,000.

As noted by BeInCrypto, over the last three months, crypto ETFs have recorded persistent net outflows. In November 2025, these ETFs saw $3.48 billion outflows, December saw an additional $1.09 billion in outflows, and January 2026 has shown a notable slowdown, with outflows reduced to $278 million. This deceleration suggests institutional selling pressure is weakening. This is happening at the same time as the US Securities and Exchange Commission (SEC) is improving its guidanceon tokenized securities. On Wednesday evening it released a statement saying, "A tokenized security is a financial instrument enumerated in the definition of 'security' under the federal securities laws that is formatted as or represented by a crypto asset, where the record of ownership is maintained in whole or in part on or through one or more crypto networks.”

It also comes as the US Senate tries to pass a crypto market structure bill that would, in part, define roles for the SEC and Commodity Futures Trading Commission in overseeing the industry.

Note: As of 5:00 pm EST 28 January 2026

Fixed Income

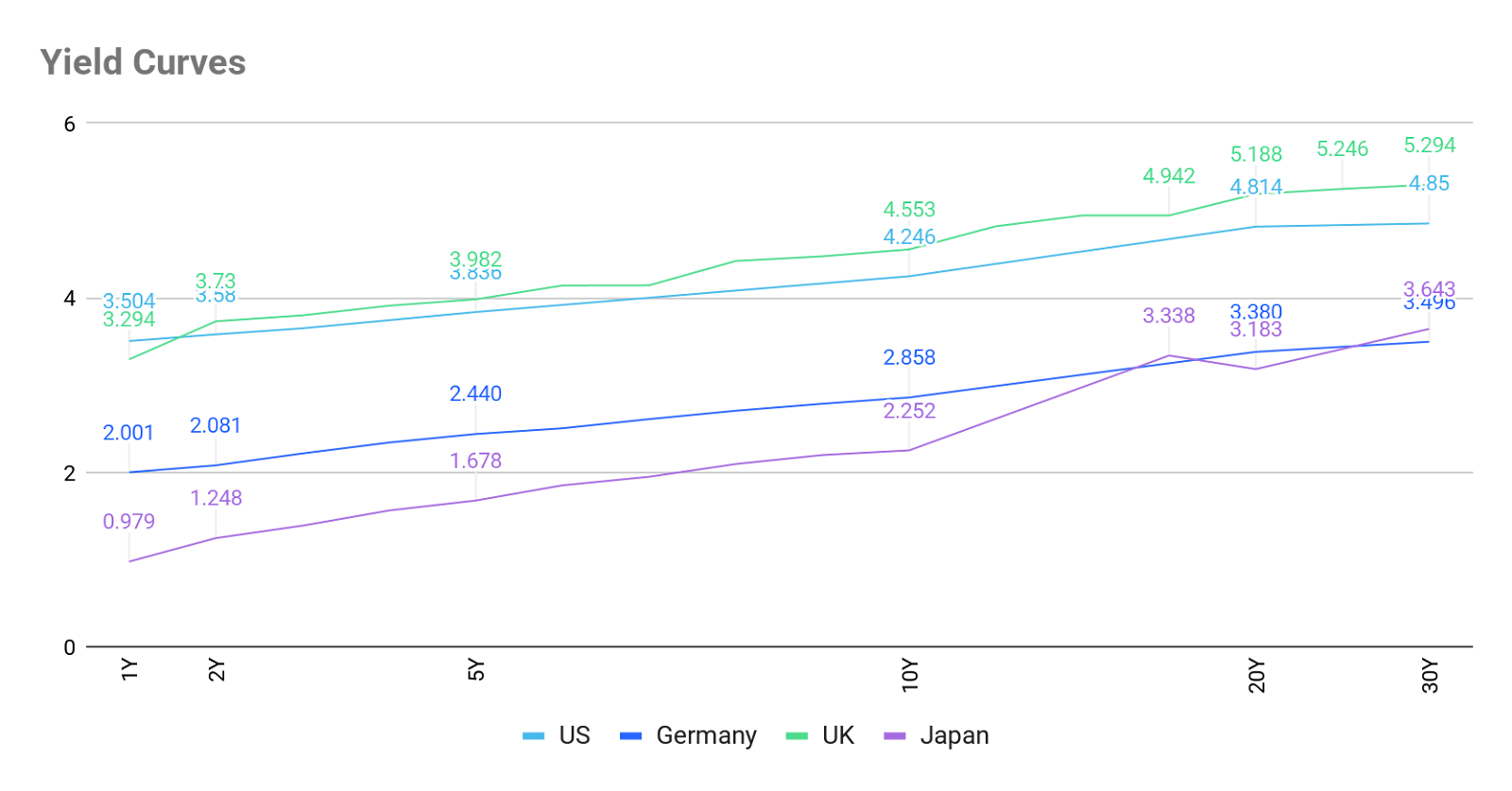

US 10-year yield +7.4 bps MTD to 4.246%

German 10-year yield -0.2 bps MTD to 2.858%

UK 10-year yield +1.9 bps MTD to 4.553%

US Treasury yields were relatively stable on Wednesday after the Federal Reserve, as widely expected, left interest rates at the 3.50-3.75% range and noted that inflation remained elevated and the labour market continued to stabilise.

Following the Fed decision, the benchmark 10-year yield ended the day -0.4 bps to 4.246%, while the 30-year yield declined -0.6 bps to 4.850%. On the front end of the curve, the two-year yield, which reflects interest rate expectations, was -0.6 bps to 3.580%.

The closely monitored yield curve, comparing two- and 10-year maturities, is at 66.6 bps thus far in January from 68.9 bps at the end of December.

The yield on the US 10-year Treasury note is +7.4 bps MTD for January. The US 30-year yield is +0.4 bps. At the short end, the two-year Treasury yield is +9.7 bps MTD.

Current sentiment in the Fed funds futures market, according to CME's FedWatch Tool, suggests a 86.5% probability of rates remaining unchanged at the March FOMC meeting. Post-Fed, markets priced in about 46 bps of easing, or fewer than two 25 bps rate cuts, for 2026. That was down from about 53 bps two weeks ago.

In the UK the 10-year gilt was +1.9 bps to 4.553% on Wednesday. On the short end, the 2-year gilt was unchanged at 3.730%. The UK's 30-year gilt yield +5.30 bps to 5.294%. In the UK, the 10 year gilt yield is +7.5 bps higher MTD. The UK 30 year is +9.5 bps so far in January.

Across the channel, short-term eurozone bond yields edged lower on Wednesday after ECB policymakers indicated that the recent appreciation of the euro could begin to influence both inflation and the trajectory of interest rates.

However, as the eurozone remains a net importer of energy, even a modest rise in the euro's value can meaningfully reduce the cost of energy and other imported goods, potentially exerting downward pressure on inflation.

Austrian central bank governor Martin Kocher, in an interview with the Financial Times, described the euro's recent gains as "modest" and not yet warranting a policy response. However, he noted that if further appreciation were to lower inflation forecasts significantly, it could prompt consideration of an interest rate cut. Similarly, Bank of France Governor François Villeroy de Galhau said the ECB is closely monitoring currency developments and their potential implications for inflation.

Other ECB officials expressed a more cautious stance. Gediminas Simkus emphasised in remarks to Econostream Media that it would be an oversimplification to suggest monetary policy should be adjusted solely based on the euro's current level, noting the possibility of future currency fluctuations.

Germany’s 10-year yield was -1.9 bps to 2.858% on Wednesday. Germany’s two-year Schatz — more responsive to expectations regarding ECB policy rates — was -2.2 bps on Wednesday to 2.081%. On the long end of the maturity spectrum, the 30-year Bund yield was +0.2 bps at 3.496%.

The German 10-year yield is -0.2 bps MTD for January. The spread between US 10-year Treasuries and German Bunds stands at 138.8 bps, reflecting an expansion of 7.6 bps over the month so far, from 131.2 bps at the end of December.

The 2-year Schatz is -5.2 bps to 2.081% so far in January. At the long end, the German 30-year yield is +1.6 bps to 3.496%.

France’s 10-year OAT yield is -1.2 bps to 3.425% MTD. The spread of French government bonds versus German Bunds has contracted by 13.2 bps over the month to 56.7 bps, from 69.9 bps at the end of December. Earlier on Wednesday, the yield spread between German and French 10-year government bonds narrowed to 55.2 bps, marking its tightest level since President Emmanuel Macron announced a snap election in June 2024. This significant tightening over the past two weeks follows the French government's decision to invoke constitutional powers to approve the 2026 budget.

Italy's 10-year government bond yield -0.7 bps to 3.461%, leaving the spread over its German equivalent at 60.3 bps. During January this spread has contracted by 8.7 bps. The Italian 10-year BTP yield has declined by -8.9 bps so far in January.

Note: As of 5:00 pm EST 28 January 2025

What to think about in February 2026

When will the Fed move? In the press conference following the FOMC policy announcement, Chair Jerome Powell said that although inflation may pick up this year, productivity rates will rise.

The FOMC statement and the press conference gave very little indication as to when the next rate cut may be, noting that "the extent and timing of additional adjustments" to the policy rate would depend on incoming data and the economic outlook. Chair Jerome Powell further struck a hawkish tone when he emphasised that a rate hike is not part of the baseline outlook for either Federal Open Market Committee voters or non‑voters. He reiterated the Fed's assessment on inflation and the labour market, noting that upside risks to inflation and downside risks to employment have both eased.

It was a 10-2 vote to keep rates at the 3.50-3.75% range. Both Governor Christopher Waller, one of the presumed three contenders to replace Powell when his term as central bank chief ends in May, and Governor Stephen Miran, on leave from his job as an economic adviser at the White House, dissented in favour of a 25 bps rate cut.

Expectations of further Fed moves will likely resurface once President Trump announces his pick to replace Jerome Powell as Fed chair.

Key events in February 2026

The potential policy and geopolitical risks for investors that could affect corporate earnings, stock market performance, currency valuations, sovereign and corporate bond markets and cryptocurrencies include:

4 February New START Treaty expiration. When New START expires, the US and Russia will face a future without any legally binding restrictions on their nuclear forces. Given the ongoing war in Ukraine and the US moving into Russia’s “sphere of influence”, this could further push NATO members into overdrive with defence budget allocations likely to be increased further.

4-5 February ECB Monetary Policy Meeting. With headline inflation in the eurozone below the 2% target, the ECB is not expected to cut rates again at this meeting. Instead, policymakers will be looking at euro strength and weakening employment figures in services and ongoing staff cuts in manufacturing. These concerns will have to be weighed against rising inflation in the services sector in terms of sales prices. Input cost inflation remains an issue as well, though it has accelerated less than sales price inflation.

5 February BoE Monetary Policy Meeting and Monetary Policy Report. With GDP rising 0.3% in November and growth in December expected to bring y/o/y GDP to above the 0% forecast, it will take greater signs of the labour market softening for the MPC to cut rates.

8 February General Elections, Thailand. This election will place the Bhumjaithai party against the progressive People’s Party and the Pheu Thai party. Latest polls indicate that forming a government is likely to take several months amid complex coalition discussions.

13-15 February Munich Security Conference, Germany. Topics addressed will likely include European security and defence, the future of the transatlantic relationship, the revitalisation of multilateralism, competing visions of the global order, regional conflicts, and the security implications of technological advances.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Ten artykuł jest publikowany wyłącznie w celach informacyjnych i nie powinien być traktowany jako oferta lub zachęta do kupna lub sprzedaży jakichkolwiek inwestycji lub powiązanych usług, do których można się tu odwołać. Obrót instrumentami finansowymi wiąże się ze znacznym ryzykiem strat i może nie być odpowiedni dla wszystkich inwestorów. Wyniki osiągnięte w przeszłości nie są wiarygodnym wskaźnikiem wyników w przyszłości.

Zarejestruj się i otrzymuj informacje rynkowe

Zarejestruj się i otrzymuj

informacje

rynkowe

Subskrybuj teraz