The end of dollar exorbitant privilege?

What to look out for today

Companies reporting on Tuesday, 13th January: JPMorgan, Delta Airlines

Key data to move markets today

USA: New Home Sales, ADP Employment Change, CPI, Core CPI, Monthly Budget Statement and speeches by St Louis Fed President Alberto Musalem and Richmond Fed President Thomas Barkin

CHINA: Exports, Imports, and Trade Balance

US Stock Indices

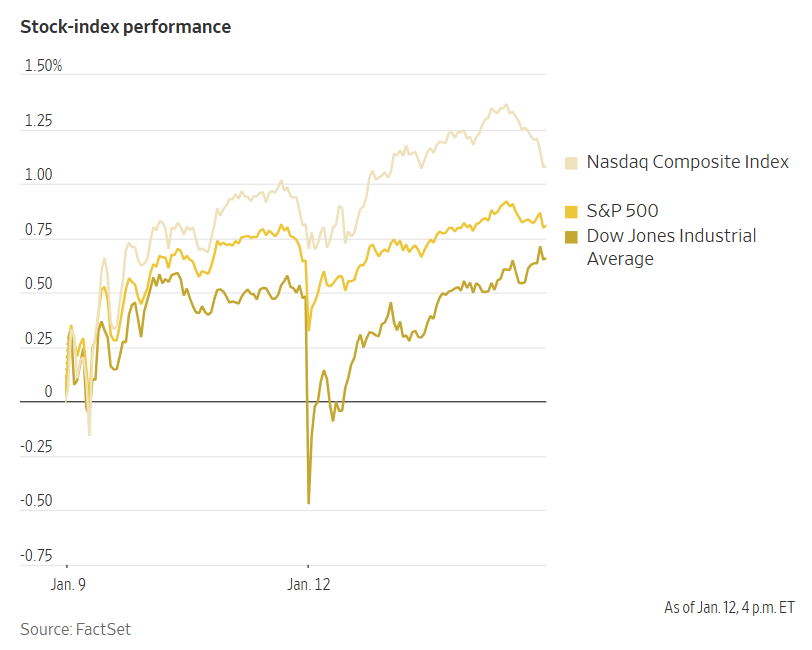

Dow Jones Industrial Average +0.17%

Nasdaq 100 +0.08%

S&P 500 +0.16%, with 9 of the 11 sectors of the S&P 500 up

US stock indexes experienced initial declines in early trading on Monday, but rebounded. The Dow Jones Industrial Average achieved another record high, closing up +0.17%, or 86.13 points. Similarly, the S&P 500 rose +0.16% to reach a new record, while the Nasdaq Composite advanced +0.26%.

In corporate developments, Nvidia announced plans to invest $1 billion over the next five years in partnership with Eli Lilly & Co. The initiative aims to accelerate AI adoption within the pharmaceutical sector.

Allegiant Travel has agreed to acquire Sun Country Airlines in a $1.5 billion cash-and-stock transaction. This deal represents further consolidation within the US airline industry, as competition among carriers intensifies.

Paramount Skydance has escalated its efforts in the ongoing contest for Warner Bros. Discovery, stating its intention to nominate board directors to prevent a merger with Netflix.

According to a new Senate report, UnitedHealth Group employed ‘aggressive strategies’ to maximise patient diagnoses and increase payments for individuals enrolled in private Medicare health plans.

Eli Lilly & Co indicated that its highly anticipated weight-loss medication is expected to obtain US regulatory approval as early as Q2 2026, a slight delay from previous projections.

QXO is securing an additional $1.8 billion in funding from investors, including Apollo Global Management and Temasek. This new investment more than doubles the financing arrangement the company announced last week.

S&P 500 Best performing sector

Consumer Staples +1.42%, with Dollar General +4.29%, Dollar Tree +3.67%, and Constellation Brands +3.28%

S&P 500 Worst performing sector

Financials -0.80%, with Synchrony Financial -8.36%, Capital One -6.42%, and American Express -4.27%

Mega Caps

Alphabet +1.09%, Amazon -0.35%, Apple +0.34%, Meta Platforms -1.70%, Microsoft -0.44%, Nvidia +0.06%, and Tesla +0.89%

Information Technology

Best performer: Western Digital +5.83%

Worst performer: ON Semiconductor -5.49%

Materials and Mining

Best performer: Albemarle +4.98%

Worst performer: International Paper Company -2.26%

European Stock Indices

CAC 40 -0.04%

DAX +0.57%

FTSE 100 +0.16%

Commodities

Gold spot +1.96% to $4,598.15 an ounce

Silver spot +6.51% to $85.16 an ounce

West Texas Intermediate +1.80% to $59.84 a barrel

Brent crude +1.92% to $64.23 a barrel

Gold surged to a record high above $4,600 per ounce on Monday. Silver also reached a new peak, as investors sought refuge in safe-haven assets.

Spot gold advanced +1.96% to end the trading day at $4,598.15 per ounce, after reaching an all-time high of $4,629.94.

Spot silver reached a historic high of $86.22 per ounce before finishing the trading day +6.51% at $85.16 per ounce.

Oil prices advanced and closed at seven-week highs on Monday, driven by concerns that Iranian exports may decline as the sanctioned OPEC member intensifies its response to anti-government demonstrations.

However, expectations of increased supply from Venezuela, another OPEC member under sanctions, tempered gains.

Brent crude futures rose $1.21, or +1.92%, to settle at $64.23 per barrel. US WTI crude gained $1.06, or +1.80%, closing at $59.84 per barrel.

This marked Brent’s highest settlement since 18th November and WTI’s since 5th December.

Iran indicated it remained open to communication with Washington as the US President considered potential responses to a severe crackdown on nationwide protests — one of the most significant challenges to the country’s clerical leadership since the 1979 Islamic Revolution.

According to data from Kpler and Vortexa, Iran currently holds a record volume of oil at sea, equivalent to approximately 50 days of output. Purchases by China have declined due to sanctions and Tehran is seeking to safeguard its supplies against potential US military action.

Venezuela is expected to resume oil exports shortly following the removal of Nicolas Maduro from power. According to four sources familiar with the process, as reported by Reuters, oil companies are expediting efforts to secure tankers and prepare for the safe shipment of crude.

During a White House meeting on Friday, representatives from the multinational commodities firm Trafigura announced that their first vessel is scheduled to load within the coming week.

Meanwhile, shipping data from LSEG revealed that two China-flagged supertankers, previously en route to Venezuela to collect crude cargoes as part of debt repayments during the US oil embargo, have reversed course and are now returning to Asia.

Investors are also closely monitoring the risk of supply disruptions from Russia, as Ukrainian attacks have targeted Russian energy infrastructure. The possibility of stricter US sanctions on Moscow’s energy sector remains.

Note: As of 4 pm EST 12 January 2026

Currencies

EUR +0.25% to $1.1666

GBP +0.47% to $1.3462

Bitcoin +0.61% to $90,973.74

Ethereum +0.21% to $3,088.84

The US dollar weakened on Monday following the US Department of Justice's announcement of a potential indictment against Fed Chair Jerome Powell regarding his testimony to Congress about a building renovation project. This development has intensified concerns over the independence of the Fed and cast uncertainty on the currency's long-term prospects.

The dollar index declined -0.26% to 98.88, while the euro appreciated +0.25% to $1.1666.

Against the Japanese yen, the dollar gained +0.18% to reach ¥158.16, after earlier touching a one-year high of ¥158.19.

The British pound also strengthened against the US dollar on Monday. Sterling rose +0.47% to $1.3462, rebounding from an earlier three-week low of $1.3392 recorded during the session.

The euro was little changed against the pound at 86.78 pence. Despite marking its fourth consecutive weekly decline last week, the euro has shown some recovery versus sterling since hitting a mid-September low of 86.44 pence last Tuesday.

Fixed Income

US 10-year Treasury +0.7 basis points to 4.182%

German 10-year bund -2.3 basis points to 2.844%

UK 10-year gilt -0.4 basis points to 4.374%

US Treasury yields exhibited limited movement on Monday, retreating from earlier peaks. The yield on the 10-year Treasury note edged up +0.7 bps to 4.182%, after reaching a session high of 4.207%.

The yield on the 30-year Treasury bond advanced +1.1 bps to 4.830%, following a decline of -5.6 bps last week — the largest weekly drop since October.

Conversely, the yield on the two-year Treasury note, sensitive to changes in Fed rate expectations, declined -0.5 bps to 3.541%.

Labour market data released on Friday indicated that the US economy generated fewer jobs than expected in December. Nonetheless, the figures were not sufficiently weak to alter prevailing market expectations for two interest rate cuts by the Fed this year. The spread between the two-year and 10-year Treasury note was 64.1 bps.

Yesterday’s auctions for $58 billion in three-year notes and $39 billion in 10-year notes were regarded as solid by analysts. The bid-to-cover ratio for the three-year notes reached 2.65x, slightly exceeding the average. Demand for the 10-year notes was 2.55x, approximately in line with historical trends.

Additional supply is expected to enter the market today, with an auction of $22 billion in 30-year bonds scheduled.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 51.7 bps of cuts in 2026, lower than the 59.7 bps priced in the previous week. Fed funds futures traders are now pricing in a 4.4% probability of a 25 bps rate cut at January’s FOMC meeting, from 16.6% a week ago. The focus now will be on upcoming consumer price index (CPI) and producer price index (PPI) data to assess the potential trajectory of Fed Funds rates.

German government bond yields fell on Monday, with the 10-year Bund yield -2.3 bps to 2.844%. The Two-year Schatz yield slipped -1.2 bps to 2.104%. At the longer end of the curve, the 30-year Bund yield decreased -3.8 bps, settling at 3.435%.

The spread between US and German 10-year yields widened to 133.8 bps, its highest level since November of last year.

Other major European sovereign yields mirrored movements in the German benchmark. Italy’s 10-year yield declined -3.6 bps to 3.469%, while France’s equivalent rate fell -2.5 bps to 3.505%.

Additional bond issuance is anticipated this week from Germany, Austria, and Italy.

Note: As of 5 pm EST 12 January 2026

Global Macro Updates

DoJ opens criminal investigation into Fed Chair Powell. The inquiry is reportedly centred on statements Fed Chair Powell delivered to Congress last June regarding the ongoing approximately $2.5 billion renovation of the Fed’s headquarters in Washington, DC. This development marks a further escalation in the tensions between the White House and the Fed, with the investigation having received approval in November. President Trump told NBC News that he has no knowledge of the investigation.

Fed Chair Powell disclosed that the Fed was served with grand jury subpoenas on Friday, threatening criminal indictment. Chair Powell characterised the administration’s actions as a pretext intended to pressure the Fed into setting interest rates in accordance with White House preferences, rather than basing decisions on empirical evidence or prevailing economic conditions.

There is speculation that President Trump may be seeking a pathway to remove Powell from his position or to dissuade him from remaining on the Board after the conclusion of his chairmanship, which ends in May; Powell’s term as governor is scheduled to continue until January 2028. The Supreme Court is still set to rule on the propriety of President Trump’s attempt to dismiss Fed Governor Lisa Cook, a Biden appointee, with oral arguments scheduled for 21st January.

The administration’s inquiry has prompted bipartisan opposition. Senate Banking Committee Chair Thom Tillis has stated that he will oppose the confirmation of any Fed Chair nominee until the matter is resolved, expressing concerns regarding the independence and credibility of the Justice Department.

Additionally, President Trump is expected to announce his selection for Powell’s successor later this month, having told the New York Times last week that he has reached a decision. Prediction markets indicate a tightening race between White House advisor Kevin Hassett, who has long been considered the frontrunner, and former Fed Governor Kevin Warsh.

December CPI preview. The December Consumer Price Index (CPI) report is scheduled for release today at 8:30 am EST. Market consensus anticipates a 0.3% increase in the headline CPI for the month, and a 0.3% gain in the core CPI. It is important to note that the previous November report encompassed both October and November as a result of the government shutdown, reflecting a 0.2% headline increase over that two-month period (up 2.7% y/o/y, with core CPI rising 2.6% y/o/y).

Analysts broadly expect an increase in December's figures, as lingering distortions from the government shutdown continue to diminish. There has been considerable discussion regarding the impact of bimonthly sampling skips in certain categories, which effectively compare prices to August levels. The headline CPI is projected to be driven higher by rising food prices and stable to increasing energy costs; however, primary attention is likely to focus on trends in core goods and core services.

Core goods are anticipated to show an increase, partly due to the late-November resumption of surveys that had previously oversampled lower holiday-season pricing. Morgan Stanley has suggested December could post the highest monthly core goods inflation for 2025.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Ten artykuł jest publikowany wyłącznie w celach informacyjnych i nie powinien być traktowany jako oferta lub zachęta do kupna lub sprzedaży jakichkolwiek inwestycji lub powiązanych usług, do których można się tu odwołać. Obrót instrumentami finansowymi wiąże się ze znacznym ryzykiem strat i może nie być odpowiedni dla wszystkich inwestorów. Wyniki osiągnięte w przeszłości nie są wiarygodnym wskaźnikiem wyników w przyszłości.

Zarejestruj się i otrzymuj informacje rynkowe

Zarejestruj się i otrzymuj

informacje

rynkowe

Subskrybuj teraz