What if there's no Santa rally this year?

Key data to move markets today

EU: Eurozone, German, French, Italian and Spanish HCOB Manufacturing PMI and speeches by ECB Vice President Luis de Guindos and Bundesbank President Joachim Nagel

UK: A speech by BoE MPC external Member Swati Dhingra

USA: A speech by Fed Chair Jerome Powell and ISM Manufacturing PMI, Prices Paid, New Orders and Employment Indices

US Stock Indices

Dow Jones Industrial Average +0.61%

Nasdaq 100 +0.78%

S&P 500 +0.54%, with 10 of the 11 sectors of the S&P 500 up

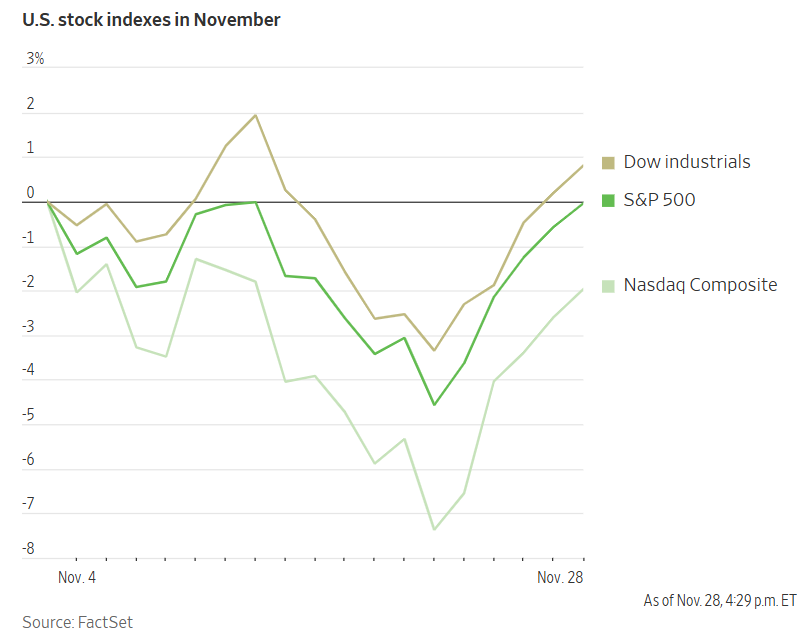

A late-November rally drove equities close to record levels, as investor confidence surrounding a possible Fed interest rate cut in December helped offset losses from an earlier midmonth decline.

On Friday, the S&P 500 advanced +0.54%, bringing the index near its record high set in late October and resulting in a modest monthly gain of +0.13%. The Dow Jones Industrial Average gained +0.61% for the day and ended November up +0.32%.

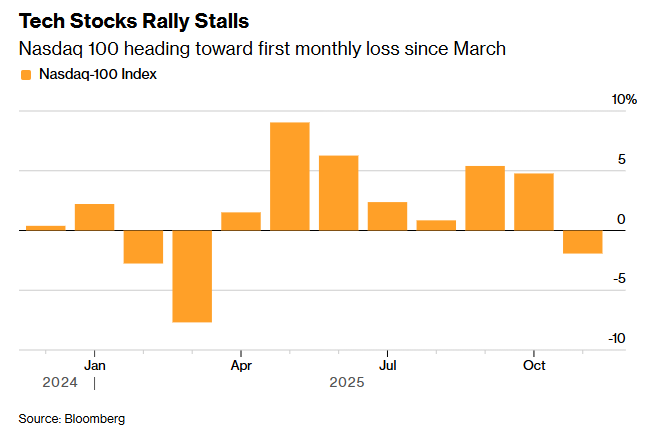

In contrast, the Nasdaq 100 posted its first monthly decline since March, dropping -1.64% amid heightened volatility and concerns about a potential AI bubble. Nonetheless, the Nasdaq rose +0.78% on Friday. Last week’s positive momentum, which pushed both the S&P 500 and Dow into positive territory for the month, marked a seventh consecutive month of gains — representing the longest winning streak for the Dow since early 2018.

According to LSEG I/B/E/S data, y/o/y earnings growth for the S&P 500 in Q3 is projected to be +14.7%. This jumps to 15.6% when excluding the Energy sector. Of the 483 companies in the S&P 500 that have reported earnings to date for Q3 2025, 83.0% have reported earnings above analyst estimates, with 78.1% of companies reporting revenues exceeding analyst expectations. The y/o/y revenue growth is projected to be 8.3% in Q3, increasing to 8.9% when excluding the Energy sector.

The Information Technology sector, at 92.3%, is the sector with most companies reporting above estimates. Industrials with a surprise factor of 15.0%, is the sector that has surpassed earnings expectations by the highest surprise factor. Within Communication Services, 40.0% of companies have reported below estimates and Real Estate is the sector with the lowest surprise factor at 4.0%. The S&P 500 surprise factor is 9.5%. The forward four-quarter price-to-earnings ratio (P/E) for the S&P 500 sits at 23.0x.

In corporate news, a software issue affecting Airbus A320 aircraft led to the temporary grounding of hundreds of planes.

As noted by Bloomberg news, Norway’s sovereign wealth fund supported Microsoft in a shareholder initiative urging the company to review its human rights vetting procedures.

S&P 500 Best performing sector

Energy +1.32%, with EQT +3.15%, Diamondback Energy +2.20%, and ConocoPhillips +1.84%

S&P 500 Worst performing sector

Health Care -0.50%, with Eli Lilly & Co -2.61%, Gilead Sciences -1.31%, and HCA Healthcare -1.26%

Mega Caps

Alphabet -0.05%, Amazon +1.77%, Apple +0.47%, Meta Platforms +2.26%, Microsoft +1.34%, Nvidia -1.81%, and Tesla +0.84%

Information Technology

Best performer: Intel +10.19%

Worst performer: Nvidia -1.81%

Materials and Mining

Best performer: Celanese +2.89%

Worst performer: International Flavors & Fragrances -0.43%

European Stock Indices

CAC 40 +0.29%

DAX +0.29%

FTSE 100 +0.27%

Commodities

Gold spot +1.41% to $4,215.82 an ounce

Silver spot +0.88% to $53.91 an ounce

West Texas Intermediate -1.15% to $58.40 a barrel

Brent crude -1.69% to $62.32 a barrel

Spot gold advanced more than one percent on Friday, climbing to a two-week high. It was +1.41% to $4,215.82 per ounce after reaching its highest intraday level since 13th November. It was +3.70% over the week and +5.35% for the month, marking its fourth consecutive monthly increase.

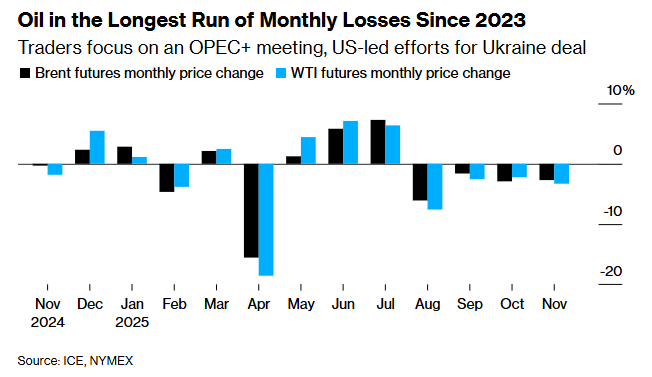

Oil prices fell on Friday as investors weighed the geopolitical risk premium associated with drawn-out Russia-Ukraine peace negotiations. The results of Sunday’s OPEC+ meeting regarding potential changes in output policy also weighed on prices.

Trading in US WTI crude futures resumed after a system outage at CME Group, which was attributed to a cooling issue at CyrusOne data centre. Brent crude trades on the Intercontinental Exchange (ICE).

Brent crude settled at $62.32 per barrel, down $1.07 or -1.69%. WTI crude closed at $58.48 per barrel, a decrease of 60 cents or -1.02% compared to Wednesday’s close. There was no settlement on Thursday due to the Thanksgiving holiday in the US.

WTI posted a gain of +0.86% over last week, while Brent declined by -0.26%. However, both benchmarks recorded their fourth consecutive monthly loss — the longest such streak since 2023 — with WTI ending November -3.94% lower and Brent down -4.23%.

Despite strength in fuel refining profit margins supporting crude demand in certain regions, expectations of an impending oil surplus have exerted downward pressure on prices. Data released by the US Energy Information Administration (EIA) on Friday revealed that US crude oil production rose to a record high in September, increasing by 44,000 barrels per day (bpd) to reach 13.84 million bpd. The recent increase in output has heightened worries of a market surplus.

Earlier last week, optimism regarding a possible peace agreement between Ukraine and Russia contributed to lower oil prices. However, as negotiations continued without resolution, prices rebounded over the past three sessions.

Additionally, sources reported to Reuters that Saudi Arabia, the world’s largest oil exporter, is expected to reduce its official selling price for January crude deliveries to Asian buyers for the second consecutive month, marking the lowest level in five years.

OPEC+ reaffirms plan to pause production hikes in Q1 2026. There were no surprises from Sunday’s OPEC+ meeting, as member countries upheld their earlier decision from November to pause production increases in Q1 2026.

The planned pause, set to begin in early 2026, means that approximately 1.2 million bpd of the remaining 1.65 million bpd supply tranche has yet to be restored, following the group’s earlier reinstatement of the initial 2.2 million bpd cut. The third supply tranche of 2 million bpd is scheduled to stay in effect through the end of 2026.

In its statement, OPEC+ reaffirmed its cautious stance in light of seasonally weaker demand, while also emphasising its readiness to either extend the production pause or reverse the voluntary cuts associated with the 2.2 million bpd tranche if necessary.

Furthermore, OPEC+ members finalised a framework for evaluating each country's production capacity, which will serve as a benchmark for determining output baselines for 2027.

Note: As of 5 pm EST 28 November 2025

Currencies

EUR +0.03% to $1.1598

GBP -0.04% to $1.3233

Bitcoin -0.12% to $90,936.00

Ethereum +0.58% to $3,033.03

The US dollar recorded its weakest weekly performance since 21st July on Friday. The dollar index declined -0.07% to 99.48, a -0.71% weekly loss.

The euro advanced +0.03% to $1.1598 and ended the week +0.76% higher. The British pound edged down -0.04% to $1.3233, but still marked its strongest weekly gain since early August. It rose +1.06% following the unveiling of UK Chancellor of the Exchequer Rachel Reeves’s budget last week.

Looking ahead, market participants are awaiting remarks from BoJ Governor Kazuo Ueda on Monday, with attention centred on any indications regarding a potential rate increase at the Bank’s December meeting. On Friday, Japanese Prime Minister Sanae Takaichi’s administration approved a ¥18.3 trillion supplementary budget for the current fiscal year to support a significant stimulus package, primarily funded through new debt issuance.

The Japanese yen was +0.08% against the US dollar on Friday, reaching ¥156.18, contributing to a +0.13% weekly gain.

Trading was temporarily disrupted overnight due to a cooling issue at CME Group’s CyrusOne data centres, resulting in an outage that suspended activity on its widely-used currency platform and stock and commodity futures. By 1:35 PM GMT, trading had resumed after being offline for more than 11 hours. Despite the disruption, currency markets remained largely stable during US trading hours, as overall volumes were already light following Thursday’s Thanksgiving holiday in the US.

Officials from the Fed entered a blackout period beginning Saturday in preparation for the FOMC meeting scheduled for 9th – 10th December.

Fixed Income

US 10-year Treasury +1.9 basis points to 4.018%

German 10-year bund +0.7 basis points to 2.692%

UK 10-year gilt -0.9 basis points to 4.447%

US Treasury yields rose on Friday and were up for a second consecutive week on rising expectations of a Fed rate cut next week.

The yield on the two-year Treasury note, sensitive to changes in Fed policy expectations, rose +1.7 bps to 3.502% on Friday. It was, however, -1.6 bps over the week. The yield on the 10-year Treasury note increased +1.9 bps to 4.018%, yet was down -5.0 bps for the week. The 30-year yield climbed +2.3 bps on Friday, but declined -4.7 bps over the week.

During November, the US Treasury yield curve steepened. The two-year yield fell -8.0 bps over the month, while the 10-year yield decreased -6.0 bps. The 30-year yield was +1.2 bps in November.

The spread between the two-year and 10-year Treasury yields reached 51.6 bps for November, up 1.9 bps from the end of October, but down 3.4 bps from the previous week.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 87.4% probability of a 25 bps rate cut at December FOMC meeting, higher than the prior week’s 71.0% and the 72.8% probability assigned at the end of October. Traders are currently expecting 21.9 bps of cuts by year-end, higher than the 17.8 bps anticipated the prior week, and the 18.8 bps expected a month ago.

Eurozone bond yields exhibited modest increases on Friday, with Germany’s 10-year bund yield rising +0.7 bps to 2.692%. Despite this uptick, the German 10-year yield declined by -1.5 bps over the week, marking its second straight weekly drop. Italy’s 10-year government bond yield also edged higher, +0.3 bps to 3.407%. On a weekly basis, however, the Italian 10-year yield fell -5.7 bps. The yield spread between Italy’s 10-year BTP and Germany’s 10-year bund narrowed to 71.5 bps, down from 75.7 bps the previous week.

Shorter-term eurozone bonds, sensitive to shifts in ECB policy, posted marginal gains as well. Germany’s two-year yield increased +0.3 bps to 2.037% on Friday, ending the week up +2.4 bps. At the long end of the curve, Germany’s 30-year yield advanced +0.5 bps to 3.321% on Friday, although it concluded the week -2.0 bps lower.

Throughout November, eurozone yields generally trended higher across maturities. Germany’s two-year yield rose +5.0 bps, the 10-year yield gained +5.8 bps, and the 30-year yield increased +10.9 bps. Italy’s 10-year yield advanced +4.4 bps during the month, while France’s 10-year yield moved in the opposite direction, declining -0.6 bps.

Note: As of 5 pm EST 28 November 2025

Global Macro Updates

UK budget is still vulnerable. S&P Ratings has cautioned that fiscal pressures in the United Kingdom are expected to endure over the medium term, despite the recent introduction of substantial revenue-raising measures. The agency emphasised that the UK’s fiscal outlook remains vulnerable, noting persistent large deficits that averaged 5.5% of GDP between 2022 and 2024, driven by a notable increase in public spending.

These concerns are consistent with warnings from domestic think tanks. The Institute for Fiscal Studies, for example, asserted that planned tax increases may be illusory, arguing that Chancellor Reeves has adopted a high-risk approach by deferring significant fiscal tightening until just before the anticipated general election in 2029. Similarly, the Resolution Foundation observed that efforts to restore fiscal balance have been postponed for three years, resulting in national debt projections that are higher — by any measure — at the end of the current parliament compared to its outset.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Ten artykuł jest publikowany wyłącznie w celach informacyjnych i nie powinien być traktowany jako oferta lub zachęta do kupna lub sprzedaży jakichkolwiek inwestycji lub powiązanych usług, do których można się tu odwołać. Obrót instrumentami finansowymi wiąże się ze znacznym ryzykiem strat i może nie być odpowiedni dla wszystkich inwestorów. Wyniki osiągnięte w przeszłości nie są wiarygodnym wskaźnikiem wyników w przyszłości.

Zarejestruj się i otrzymuj informacje rynkowe

Zarejestruj się i otrzymuj

informacje

rynkowe

Subskrybuj teraz