Is credit risk undermining confidence?

What to look out for today

Companies reporting on Friday, 17th October: American Express, State Street, Schlumberger, Truist Financial, Fifth Third Bancorp, Volvo

Key data to move markets today

EU: Eurozone’s Harmonised Index of Consumer Prices and Core Harmonised Index of Consumer Prices, and a speech by Bundesbank President Joachim Nagel

UK: Speeches by BoE Chief Economist Huw Pill, BoE External Member Megan Greene and BoE Deputy Governor Sarah Breeden

USA: Building Permits, Housing Starts, Industrial Production, and a speech by St Louis Fed President Alberto Musalem

GLOBAL: IMF and World Bank Fall Meeting

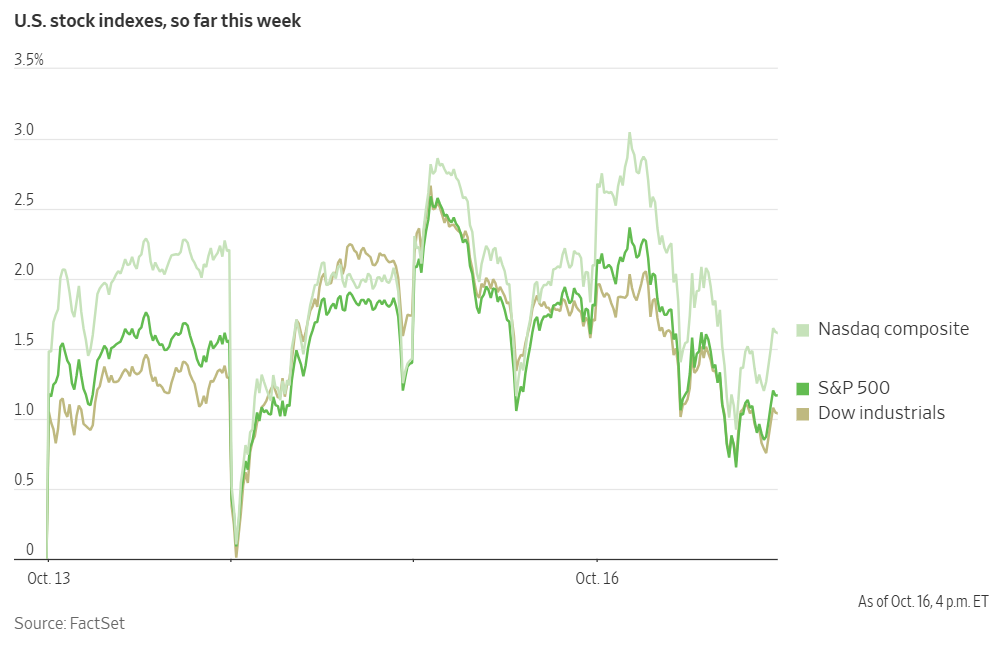

US Stock Indices

Dow Jones Industrial Average -0.63%

Nasdaq 100 -0.36%

S&P 500 -0.63%, with 10 of the 11 sectors of the S&P 500 down

Concerns regarding the stability of regional banks exerted downward pressure on major stock indexes. The Dow Jones Industrial Average declined by 301 points, representing a -0.65% decrease. The S&P 500 fell by -0.63%, while the Nasdaq Composite dropped -0.47%.

The downturn was widespread, with losses recorded in 10 out of 11 S&P 500 sectors. However, Financials was particularly affected, contracting by -2.75% and erasing all gains achieved after robust earnings reports from the nation’s six largest banks earlier in the week.

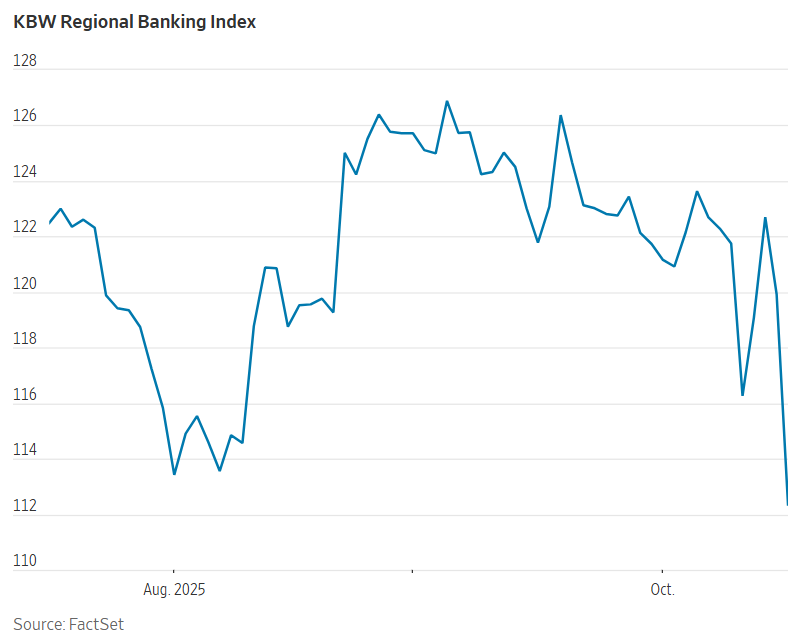

The KBW Nasdaq Regional Banking Index declined -6.31%, its steepest single-day drop since the tariff-induced volatility in April. This followed Zions Bancorp’s announcement late Wednesday of a $50 million charge-off to cover two loans linked to borrowers facing legal proceedings. Additionally, Western Alliance disclosed on Thursday that it had initiated legal action in August against a borrower, alleging fraudulent activity. As a result, shares of Zions Bancorp declined by -13.14%, while Western Alliance’s shares fell by -10.81%.

These developments intensified concerns that robust credit markets may be masking underlying vulnerabilities or excesses. Earlier in the week, JPMorgan Chase reported a $170 million charge related to the bankruptcy of auto-loan lender Tricolor, which faces accusations of fraud. CEO Jamie Dimon commented to investors, ‘when you see one cockroach, there are probably more.’

Major banks also retreated following strong earnings earlier in the week. Bank of America and Citigroup both recorded declines of -3.52% and -3.53%, respectively. Jefferies fell by -10.62% as its management addressed investor concerns during its investor day earlier on Thursday, particularly regarding its involvement with the defunct auto-parts company First Brands.

Although analysts anticipate that these issues will remain isolated, investors are acutely sensitive to stress within the banking sector, especially in light of the market disruptions caused by the collapse of Silicon Valley Bank in 2023.

In corporate news, Oracle provided guidance on gross margins for large-scale AI infrastructure initiatives, helping to alleviate some of analysts’ concerns regarding the profitability of this pivotal new business segment.

Salesforce forecasted sustained double-digit revenue growth in the coming years, which helped to dispel investor apprehensions about a potential slowdown.

General Motors has suspended the second phase of a cathode production facility in Quebec. This decision has led to the cancellation of Vale’s nickel sulfate project.

BBVA’s $19 billion bid for Banco Sabadell was rejected by nearly 75% of shareholders, marking the conclusion of a 17-month takeover pursuit and representing a significant setback for BBVA.

DoorDash customers in the Phoenix region may soon have their orders delivered by Waymo autonomous vehicles, as part of a newly established partnership designed to utilise the robotaxis during periods of low passenger demand.

Pernod Ricard reported Q3 sales that declined more sharply than anticipated due to a pronounced drop in demand from China and the liquidation of excess inventory in the US.

EssilorLuxottica exceeded analysts’ revenue expectations in the third quarter, bolstered by the launch of a new range of AI-powered glasses developed in partnership with Meta Platforms.

S&P 500 Best performing sector

Information Technology +0.13%, with Micron Technology +5.52 %, ON Semiconductor +5.18%, and Western Digital +4.55%

S&P 500 Worst performing sector

Financials -2.75%, with Marsh & McLennan Companies -8.52%, Brown & Brown -6.97%, and Citizens Financial Group -6.40%

Mega Caps

Alphabet +0.07%, Amazon -0.51%, Apple -0.76%, Meta Platforms -0.76%, Microsoft -0.35%, Nvidia +1.10%, and Tesla -1.47%

Information Technology

Best performer: Micron Technology +5.52%

Worst performer: F5 -10.70%

Materials and Mining

Best performer: Newmont +5.01%

Worst performer: Nucor -3.00%

European Stock Indices

CAC 40 +1.38%

DAX +0.38%

FTSE 100 +0.12%

Corporate Earnings Reports

Posted on Thursday, 16th October

Taiwan Semiconductor Manufacturing quarterly revenue +36.9% to $32.338 bn vs. $32.072 bn estimate.

EPS at $2.85 vs. $2.63 estimate.

Wendell Huang, Senior VP and CFO, said, “Our business in the third quarter was supported by strong demand for our leading-edge process technologies. Moving into fourth quarter 2025, we expect our business to be supported by continued strong demand for our leading-edge process technologies.” — see report.

United Airlines quarterly revenue +2.6% to $15.225 bn vs. $15.332 bn estimate.

EPS at $2.78 vs. $2.65 estimate.

Scott Kirby, CEO, said, “We've invested in customers at every price point: Seatback screens, an industry-leading mobile app, extra legroom, a lie-flat United Polaris seat, and fast, free, reliable Starlink on every plane by 2027. Our customers value the United experience, making them increasingly loyal to United. Those investments over almost a decade, combined with great service from our people, have allowed United to win and retain brand-loyal customers, leading to economic resilience even with macro economic volatility through the first three quarters of the year and significant upside as the economy and demand are improving in the fourth quarter.” — see report.

Travelers quarterly revenue +1.4% to $11.473 bn vs $11.688 bn estimate.

EPS at $8.14 vs $6.39 estimate.

Alan Schnitzer, Chairman and CEO, said, “We are very pleased to report another quarter of excellent results. We earned core income of $1.9 billion, or $8.14 per diluted share, generating core return on equity of 22.6%. Very strong underwriting results and higher investment income drove the bottom line. Underwriting income of $1.4 billion pre-tax more than doubled compared to the prior year quarter, benefiting from both a lower level of catastrophe losses and higher underlying underwriting income. The underlying result was driven by higher net earned premiums and an underlying combined ratio that improved to an exceptional 83.9%. Underwriting income was higher in all three segments. Our high-quality investment portfolio continued to perform well, generating after-tax net investment income of $850 million, up 15%. During the quarter, we returned almost $900 million of excess capital to shareholders, including $628 million of share repurchases.”— see report.

Commodities

Gold spot +3.08% to $4,338.39 an ounce

Silver spot +2.11% to $54.19 an ounce

West Texas Intermediate -2.14% to $57.49 a barrel

Brent crude -2.11% to $61.11 a barrel

Gold hit a record high for the fourth straight session on Thursday, as investors flocked to the safe-haven metal on brewing US - China trade tensions and the US government shutdown, with bets on interest rate cuts fuelling the momentum.

Spot gold was up +3.08% at $4,338.39 per ounce, its fourth record high this week.

Oil prices declined by more than two percent on Thursday following statements from the US President indicating that he and his Russian counterpart had agreed to meet in Hungary soon to discuss resolving the conflict in Ukraine.

This development injected uncertainty into global energy markets. Brent crude futures settled $1.32, or -2.11%, lower at $61.11 per barrel, while US WTI futures closed $1.26, or -2.14%, lower at $57.49 per barrel. These settlements marked the lowest levels for both benchmarks since 5th May.

President Trump announced that the meeting with President Putin was arranged for Budapest in the near future, though the specific date was not disclosed. The announcement came one day before the US President was scheduled to hold talks with Ukrainian leader Volodymyr Zelenskiy.

Further pressure on oil prices arose from the Energy Information Administration’s (EIA) report, which indicated that US crude inventories increased by 3.5 million barrels to 423.8 million barrels last week.

Market participants were also monitoring the possibility of India halting its imports of Russian oil—a move that could shift global trade flows and increase demand for alternative suppliers. President Trump stated that Prime Minister Narendra Modi had pledged on Wednesday to cease purchasing oil from Russia, which currently supplies approximately one-third of India's oil imports. Some Indian refiners are reportedly preparing to reduce their intake of Russian oil, with expectations of a gradual decline according to Reuters.

However, on Thursday, Indian officials reiterated that the nation's primary objectives are to maintain stable energy prices and ensure reliable supply, without directly addressing the US President’s statements. Meanwhile, Russian authorities expressed confidence in the continued strength of their energy partnership with India.

Additionally, the British government announced new sanctions on Wednesday, specifically targeting Russia’s Rosneft and Lukoil, two of the world's largest energy companies.

EIA report. According to data released by the EIA on Thursday, US crude oil inventories increased by 3.5 million barrels to a total of 423.8 million barrels during the week ending 10th October. This build occurred as refinery crude runs—the volume of oil processed by refineries—declined sharply, reaching 14.7 million barrels per day (bpd), the lowest level observed since February 2024. Refinery utilisation rates also fell, dropping by 6.7 percentage points to 85.7%, which is the lowest rate since the week of 14th February.

At the Cushing, Oklahoma, delivery hub, crude stocks decreased by 703,000 barrels within the same period. Net US crude imports saw a significant reduction as well, falling by 1.75 million bpd to 1.06 million bpd.

In terms of refined products, US distillate stockpiles—which encompass diesel and heating oil—declined by 4.5 million barrels to 117 million barrels, based on EIA data. Demand indicators eased, with product supplied of distillate fuel oil decreasing by 113,000 bpd to 4.23 million bpd, while gasoline supplied dropped by 464,000 bpd to 8.45 million bpd. Additionally, US gasoline inventories fell by 267,000 barrels over the week, reaching 218.8 million barrels.

Note: As of 5 pm EDT 16 October 2025

Currencies

EUR +0.38% to $1.1687

GBP +0.31% to $1.3432

Bitcoin -2.87% to $108,111.71

Ethereum -2.18% to $3,885.54

On Thursday, the US dollar recorded its third consecutive decline against major currencies, including the euro, yen, and Swiss franc. The dollar depreciated by -0.49% versus the Swiss franc, reaching CHF 0.793. The dollar index slipped by -0.33% to 98.34.

The euro rose to a one-week high, appreciating by +0.38% to $1.1687, while the British pound advanced +0.31% to $1.3432.

Seiichi Shimizu, Assistant Governor of the BoJ, cautioned that the central bank must proceed carefully with monetary policy normalisation, citing uncertainty regarding the economy’s response to a new environment of positive interest rates. Following Shimizu’s remarks, the dollar extended its losses against the yen, falling -0.44% on the day to ¥151.38.

Fixed Income

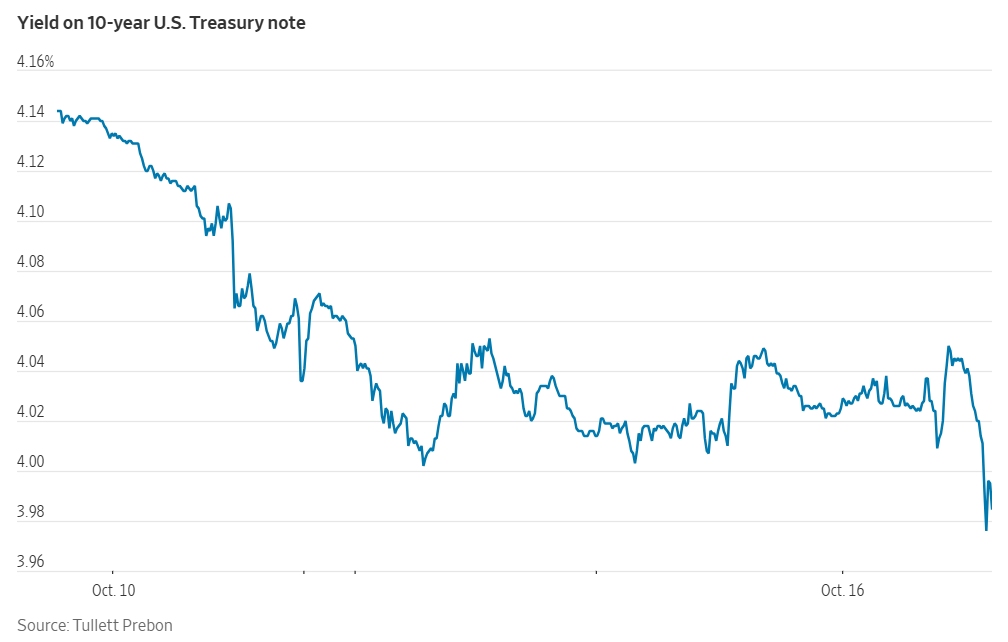

US 10-year Treasury -5.2 basis points to 3.981%

German 10-year bund unchanged at 2.575%

UK 10-year gilt -4.9 basis points to 4.502%

US Treasury yields declined on Thursday, continuing a marked downward trend that began last Friday after the US President threatened to impose triple-digit tariffs on Chinese goods. This development was followed by both nations implementing additional port fees targeting ocean shipping firms and US officials voicing concerns over China’s expanded controls on rare earth exports.

The yield on the 10-year Treasury note fell by -5.2 bps to 3.981%, its lowest level in over a year and the first close below 4% since April. The yield spread between two- and 10-year Treasury notes stood at 55.5 bps. The two-year Treasury yield, which is closely tied to market expectations for Fed funds rate policy, declined by -8.4 bps to 3.426%. At the longer end of the curve, the yield on the 30-year Treasury bond decreased by -3.8 bps to 4.590%.

Despite the ongoing government shutdown, select economic indicators continue to be published. The Philadelphia Fed reported that its business activity index fell sharply to -12.8 this month from 23.2 in September, significantly below the forecasted 8.5. A negative reading indicates contraction in regional business activity.

The National Association of Home Builders/Wells Fargo Housing Market Index indicated that homebuilder confidence rose to a six-month high in October, driven by optimism that falling mortgage rates could spur greater demand for housing.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 96.8% probability of a 25 bps rate cut at October’s FOMC meeting, higher than last week’s 94.1%. Traders are currently anticipating 52.9 bps of cuts by year-end, higher than the 45.0 bps expected last week.

Across the Atlantic, eurozone bond yields exhibited minimal movement on Thursday, pausing after a four-day rally that had previously lowered borrowing costs to their lowest levels in months. Market focus was on France, where Prime Minister Sebastien Lecornu successfully overcame two no-confidence votes in parliament. The French government gained reprieve following Lecornu’s pledge to suspend landmark pension reform, resulting in support from select left-wing lawmakers.

This week has seen increased attention on the impact of the US President’s trade policies, especially amidst rising tensions between Washington and Beijing.

German ten-year Bund yields are set to register their fourth consecutive weekly decline—the longest streak since late March—having fallen for four successive days to their lowest point in over three months. On Thursday, yields held steady at 2.575%.

Long-term bonds, which have generally experienced greater pressure this year due to concerns regarding government finances, have also noted stronger demand. However, the yield on the 30-year German Bund rose by +1.3 bps to 3.163%, while the two-year Schatz yield fell by -1.3 bps to 1.913%.

French ten-year OAT yields are positioned for their largest weekly decrease of 2025, as investors respond to Lecornu’s decision to suspend pension reforms—a measure that may improve prospects for passing a fiscally conservative budget.

The 10-year OAT yield is down -13.2 bps so far this week, marking the largest drop in a year and reaching 3.342%. Although these yields remain among the highest in the eurozone, they continue to retreat from the multi-month highs observed in early October.

Note: As of 5 pm EDT 16 October 2025

Global Macro Updates

Dovish Fedspeak from Governors Waller and Miran. Fed Governor Waller reiterated his argument for additional monetary easing, describing the current policy as ‘moderately restrictive.’ In a speech on Thursday, he highlighted the conflict between data indicating solid economic growth and other figures showing a softening labour market. In an interview with Bloomberg, Fed Governor Waller stated his belief that the neutral interest rate is approximately 100 to 125 bps lower than its current level. He emphasised that the Fed should be prepared to act if further weakness in the labour market emerges, and he also cited the potential for AI to reduce labour demand, though he stressed that the implications for monetary policy remain uncertain. At the same time, he cautioned against moving too quickly on rate cuts to avoid rekindling inflationary pressures, should GDP and job growth accelerate.

Separately, Fed Governor Stephen Miran maintained his dovish stance in an interview with Fox Business. He suggested that ongoing trade tensions with China could weigh on economic growth, making policy easing more urgent. Fed Governor Miran specified that he would favour a 50 bps interest rate cut at the upcoming FOMC meeting on 29th October, a more aggressive move than the 25 bps reduction that is widely expected by market consensus. In comments reported by Reuters, he also indicated that he is not overly concerned with elevated asset prices.

UK economic activity shows modest growth in August. The UK's economic activity data for August 2025 indicated a modest expansion, with monthly GDP increasing by 0.1%, in line with expectations. This followed a 0.1% contraction in the prior month, a figure that was revised downward from the initial flat reading. A sectoral breakdown reveals a mixed performance for August: production grew by a solid 0.4%, while the services sector showed no growth and construction output fell by 0.3%.

On a three-month rolling basis, overall output expanded by 0.3%, an acceleration from the previous 0.2% reading. This was driven primarily by 0.4% growth in the services sector and a 0.3% rise in construction, which offset a 0.3% decline in production over the same period.

Concurrently, the latest trade figures revealed that the total deficit in goods and services widened by £1.7 billion to £5.2 billion in the three months to August 2025, following a larger drop in exports than imports. Specifically, total goods exports decreased by 3.3%, driven by a 5.3% decline in exports to the EU and a 1.5% reduction in exports to non-EU countries. The policy implications of these developments remain limited. After considerable trade-related volatility in growth during H1 2025, a period of moderation had been broadly anticipated. The BoE currently projects a quarterly growth rate of approximately 0.25% for H2 2025. Economic activity may be subdued in the coming months due to ongoing uncertainty surrounding fiscal policy, which has contributed to weaker household consumption, a decline in business activity, and softer sentiment indicators.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Ten artykuł jest publikowany wyłącznie w celach informacyjnych i nie powinien być traktowany jako oferta lub zachęta do kupna lub sprzedaży jakichkolwiek inwestycji lub powiązanych usług, do których można się tu odwołać. Obrót instrumentami finansowymi wiąże się ze znacznym ryzykiem strat i może nie być odpowiedni dla wszystkich inwestorów. Wyniki osiągnięte w przeszłości nie są wiarygodnym wskaźnikiem wyników w przyszłości.

Zarejestruj się i otrzymuj informacje rynkowe

Zarejestruj się i otrzymuj

informacje

rynkowe

Subskrybuj teraz