Will trade uncertainty disrupt global growth?

What to look out for today

Companies reporting on Wednesday, 15th October: Bank of America, Abbott Laboratories, Morgan Stanley, Prologis, Synchrony Financial

Key data to move markets today

EU: French CPI, Spanish Harmonised Index of Consumer Prices, Eurozone Industrial Production, and a speech by ECB Vice President Luis de Guindos

UK: Speeches by BoE Deputy Governors Dave Ramsden and Sarah Breeden

USA: New York Empire State Manufacturing Survey, Fed’s Beige Book, and speeches by Fed Governor Stephen Miran, Fed Governor Christopher Waller, and Kansas City Fed President Jeff Schmid

GLOBAL: IMF and World Bank Fall Meeting

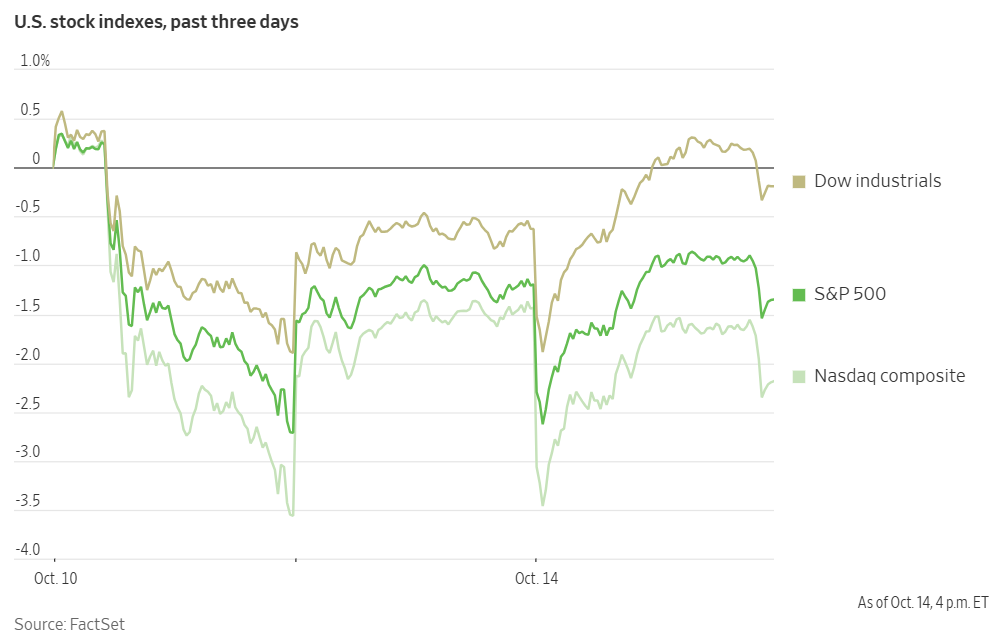

US Stock Indices

Dow Jones Industrial Average +0.44%

Nasdaq 100 -0.69%

S&P 500 -0.16%, with 3 of the 11 sectors of the S&P 500 down

Trade tensions between the US and China triggered significant volatility across equity markets on Tuesday, with the Dow Jones Industrial Average recording its largest intraday recovery since April. The session began with a sharp decline following Beijing's effective sanctioning of US divisions belonging to a major South Korean shipbuilding firm, Hanwha Ocean. Chinese authorities alleged that the subsidiaries supported the US government and adversely affected the interests of Chinese companies.

However, market sentiment began to improve after a US official indicated that trade relations between the two countries were not deteriorating further. The rebound accelerated following remarks from Fed Chair Jerome Powell, which heightened expectations of additional interest rate cuts.

By the close of trading, the Dow Jones Industrial Average was +0.44% or up 203 points, while the S&P 500 slipped -0.16%. The Russell 2000 index advanced +1.38% to finish at a record high. The Russell 2000 experienced its largest intraday comeback—measured by the percentage change from its lowest point during the session to the closing value—since September 2024.

In corporate news, BlackRock attracted $205 billion in client inflows during Q3, as the world's largest asset manager expanded its reach in private credit and alternative investments.

Advanced Micro Devices secured a significant order from Oracle for its upcoming MI450 chips, underscoring the company's progress in challenging Nvidia’s dominance within the AI processor sector.

Salesforce reported annual savings of approximately $100 million by integrating AI tools into its customer service operations.

Alphabet's Google announced plans to invest around $15 billion over the next five years to establish an AI infrastructure hub in southern India. This represents its most substantial commitment to the region to date.

Walmart revealed a partnership with OpenAI, enabling customers to browse and purchase products via ChatGPT as part of the retailer's ongoing efforts to leverage artificial intelligence.

Johnson & Johnson disclosed plans to separate its slower-growing orthopedics division from the remainder of the company within the next 18 to 24 months. This strategic move aims to provide greater operational flexibility for its innovative pharmaceuticals and medical device businesses, particularly as the current US administration intensifies pressure on pharmaceutical pricing.

S&P 500 Best performing sector

Consumer Staples +1.72 %, with Walmart +4.98 %, Dollar Tree +3.23%, and Kroger +2.98 %

S&P 500 Worst performing sector

Information Technology -1.59%, with Arista Networks -5.87%, Western Digital -4.82%, and Nvidia -4.40%

Mega Caps

Alphabet +0.63%, Amazon -1.67%, Apple +0.04%, Meta Platforms -0.99%, Microsoft -0.09%, Nvidia -4.40%, and Tesla -1.53%

Information Technology

Best performer: HP +4.35%

Worst performer: Arista Networks -5.87%

Materials and Mining

Best performer: Martin Marietta Materials +2.86%

Worst performer: Mosaic -3.36%

European Stock Indices

CAC 40 -0.18%

DAX -0.62%

FTSE 100 +0.10%

Corporate Earnings Reports

Posted on Tuesday, 14th October

Wells Fargo quarterly revenue +5.3% to $21.436 bn vs. $21.146 bn estimate.

EPS at $1.66 vs. $1.55 estimate.

Charlie Scharf, Chairman and CEO, said, “The momentum we are building across our businesses drove strong financial results in the third quarter with net income and diluted earnings per share both up from a year ago and the second quarter. Revenue grew with higher net interest income and strong, broad-based growth in fee-based income across both our consumer and commercial businesses. We grew our balance sheet, including the highest linked quarter loan growth in over three years. Credit performance was strong and continued to improve. We returned a significant amount of capital to our shareholders in the third quarter including increasing our common stock dividend by 12.5% and repurchasing $6.1 billion of common stock.” — see report.

Citigroup quarterly revenue +8.7% to $22.090 bn vs. $21.086 bn estimate.

EPS at $1.86 vs. $1.73 estimate.

Jane Fraser, CEO, said, “The relentless execution of our strategy is delivering stronger business performance quarter after quarter and improving our returns. The cumulative effect of what we have done over the past years – our transformation, our refreshed strategy, our simplification – have put Citi in a materially different place in terms of our ability to compete. Investments in new products, digital assets and AI are driving innovation and improved capabilities across the franchise.” — see report.

Goldman Sachs quarterly revenue +19.6% to $15.2 bn vs $14.13 bn estimate

EPS at $12.25 vs $11.02 estimate.

David Solomon, Chairman and CEO of Goldman Sachs, said, “This quarter's results reflect the strength of our client franchise and focus on executing our strategic priorities in an improved market environment. Across our business, clients continue to turn to us for their most complex and consequential matters. We know that conditions can change quickly and so we remain focused on strong risk management. Longer term, we are prioritizing the need to operate more efficiently to seamlessly deliver the firm to our clients helped by new AI technologies.”— see report.

Domino’s Pizza quarterly revenue +4.7% to $1.217 bn vs. $1.198 bn estimate.

EPS at $1.53 vs. $1.38 estimate.

Russell Weiner, CEO, said, “I am incredibly proud of how our team and franchise system is bringing our Hungry for MORE strategy to life and delivering best in class results. In the U.S., we drove positive order counts behind our Best Deal Ever promotion and stuffed crust pizza product innovation for the third quarter. This resulted in another quarter of strong growth in both our delivery and carryout businesses. Seeing our strategy being executed at such a high level gives me the confidence that we will continue to win and take QSR pizza market share around the world in 2025 and beyond. We have never had more tools to drive long-term value creation for our franchisees and shareholders.” — see report.

Commodities

Gold spot +0.78% to $4,140.87 an ounce

Silver spot -1.70% to $51.45 an ounce

West Texas Intermediate -1.58% to $58.71 a barrel

Brent crude -1.78% to $62.25 a barrel

Gold reached another new all-time high, surpassing $4,100 on Tuesday, driven by rising expectations of an interest rate cut by the Fed and heightened investor demand for safe-haven assets following renewed trade tensions between Washington and Beijing.

Spot gold was +0.78% to $4,140.87 per ounce, after earlier touching a record $4,179.48 during the session. As a non-yielding asset, gold typically benefits from low interest rate environments and market participants currently anticipate a 25 bps reduction at the FOMC meeting later this month. A similar cut is projected for December.

Silver soars to record high amid London market frenzy. On Tuesday, silver prices reached an all-time high as heightened demand in London fuelled a rally that has already surpassed gold’s. In early trading on Tuesday, silver soared to $53 per ounce, marking an increase of more than 78.2% year-to-date. This surge can be attributed to investors who regard silver as a proxy for gold, and robust demand from industries such as electronics and solar panel manufacturing. Additionally, there has been increased purchasing from Indian buyers preparing for the wedding season.

With silver inventories in London nearing historic lows, a premium of $1 to $2 per ounce emerged compared to the price on the Comex futures exchange in New York. In response, some traders have resorted to the unusual practice of transporting silver by air from New York to London. This method is typically reserved for gold due to the bulkiness of silver, which is usually shipped by sea.

This supply squeeze has driven silver prices beyond levels seen during the infamous Hunt brothers’ silver squeeze of 1980. Traders often refer to silver as ‘gold on steroids,’ given its tendency to exhibit more pronounced price fluctuations than gold during periods of market stress. Concerns over potential US tariffs have led to an accumulation of physical silver in New York, as market participants await Washington’s decision on whether to impose levies on silver imports—further aggravating the shortage in London.

Oil prices declined sharply on Tuesday, closing over 1.5 percentage points lower following a warning from the International Energy Agency (IEA) about the potential for a significant supply surplus in 2026. Ongoing trade tensions between the US and China, the world's two largest economies, further contributed to bearish sentiment.

Brent crude futures dropped by $1.13, or -1.78%, to settle at $62.25 per barrel. US WTI crude fell -1.58%, or 94 cents, to $58.71 per barrel. Both benchmarks hit their lowest in five months.

The IEA forecasted that the global oil market could face a surplus of up to 4 million barrels per day (bpd) in the coming year, as OPEC+ members and other producers ramp up output amid persistently weak demand. This outlook, combined with heightened trade frictions, has fostered a risk-averse environment among investors.

The six-month spread for Brent oil futures narrowed to its smallest premium since early May, while the WTI spread reached its tightest margin since January 2024. This reduction in backwardation—where immediate delivery commands a higher price than future delivery—indicates that traders are deriving less profit from spot sales, as ample near-term supply diminishes the premium for prompt physical delivery.

Note: As of 5 pm EDT 14 October 2025

Currencies

EUR +0.31% to $1.1607

GBP -0.09% to $1.3316

Bitcoin -2.25% to $113,208.18

Ethereum -3.39% to $4,118.04

The US dollar was down on Tuesday amid renewed trade tensions between the US and China.

The US implemented additional port fees on ocean shipping companies handling a wide range of goods, from holiday merchandise to crude oil. In response, Beijing initiated countermeasures targeting five US-linked subsidiaries of South Korean shipbuilder Hanwha Ocean and began investigating the impact of the US Section 301 probe into alleged unfair foreign trade practices on its domestic shipping sector.

The euro advanced against the dollar, gaining +0.31% to $1.1607. The greenback fell against the Swiss Franc, -0.37% to CHF 0.801, and eased against the Japanese yen -0.33% to ¥151.72.

However, the British pound was -0.09% against the dollar, trading at $1.3316. The pound also softened against the euro, with the euro +0.37% to 87.08 pence. According to the UK Office for National Statistics, unemployment edged up to 4.8%, driven by higher joblessness among younger workers. Average weekly earnings excluding bonuses increased at the slowest pace since May 2022, rising by 4.7% y/o/y in the June - August period, marginally below the 4.8% rise in the preceding three months. In the private sector, earnings excluding bonuses grew 4.4%. Futures markets currently anticipate a roughly 40% probability of a BoE rate cut in December, with a full rate reduction not expected until March.

Fixed Income

US 10-year Treasury -0.2 basis points to 4.034%

German 10-year bund -2.6 basis points to 2.611%

UK 10-year gilt -7.1 basis points to 4.589%

US Treasury yields fell Tuesday after remarks from Fed Chair Jerome Powell.

The yield on the 10-year Treasury note decreased slightly, -0.2 bps to 4.034%. The two-year note yield, highly sensitive to monetary policy expectations, was -2.1 basis points to 3.491%. On the long end, the 30-year yield was +1.1 bps to 4.632%.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 97.3% probability of a 25 bps rate cut at October’s FOMC meeting, higher than last week’s 95.1%. Traders are currently anticipating 48.4 bps of cuts by year-end, higher than the 45.4 bps expected last week.

Across the Atlantic, eurozone government bond yields reached new multi-week lows, as investors became increasingly concerned about the potential economic repercussions stemming from ongoing trade disputes. This uncertainty has the potential to hinder corporate decision-making and delay future investment strategies.

Germany's 10-year yield was -2.6 bps to 2.611%, after briefly touching 2.588%—its lowest level since 23rd July. At the shorter end, the German 2-year bond—typically more responsive to expectations regarding ECB policy—was -0.8 bps to 1.941% during late trading. On the long end, the yield on Germany's 30-year bonds remained unchanged at 3.220%.

French government bonds experienced additional downward pressure following Prime Minister Sebastien Lecornu's announcement to postpone the implementation of the landmark 2023 pension reform until after the 2027 presidential election. This decision, made in response to demands from leftist lawmakers, aims to maintain political stability and avoid the immediate threat of a snap parliamentary election.

As a result, yields on the benchmark 10-year French OAT dropped -6.0 bps to 3.414%, marking their largest single-day decline since mid-August and reaching the lowest point in just over a month. The yield premium of French bonds over German Bunds fell to 80.3 bps, below last week's nine-month high of 88.9 bps.

The French government is set to issue approximately €11.5 billion in debt on Thursday, which will provide a critical test of investor appetite.

Money markets reflected a rising probability of monetary easing, with a roughly 70% chance of a 25 bps cut from the ECB by next July, an increase from about 65% the previous day. Projections indicate the ECB deposit rate could decrease to 1.90% by February 2027, compared to the current rate of 2.00%.

Note: As of 5 pm EDT 14 October 2025

Global Macro Updates

Fed Chair Powell says outlook for inflation and employment remained consistent with September's figures. In an address to the National Association of Business Economics, Fed Chair Jerome Powell indicated that, based on available data, the economic outlook for employment and inflation has not materially changed since the September FOMC meeting. He acknowledged that while the official September employment report has been delayed due to the government shutdown, current evidence suggests that both hiring and layoff activity remain subdued. Fed Chair Powell also noted a continued downward trend in the perceived difficulty of hiring among both households and firms.

Regarding inflation, he suggested that recent increases in goods prices primarily reflect the impact of tariffs rather than broader inflationary pressures. He did note that near-term inflation expectations have generally risen. He reiterated the Fed's commitment to a meeting-by-meeting approach to policymaking, emphasising that future decisions will be contingent upon the evolution of the economy and the associated balance of risks. The speech also placed a significant focus on balance-sheet policy, with Fed Chair Powell concluding that the ample reserves regime has proven to be remarkably effective.

Overall, the remarks were broadly in line with market expectations and are unlikely to shift the prevailing consensus for two additional 25 bps rate cuts by the end of the year.

IMF: Growth forecasts and risks - October 2025. The IMF projects continued economic deceleration across major economies in 2025 - 2026. Global growth is forecast to slow from 3.3% in 2024 to 3.2% in 2025 and further to 3.1% in 2026, representing a significant decline from the pre-pandemic average of 3.7%.

Advanced economies face particularly challenging prospects, with growth projected at just 1.6% for both 2025 and 2026. The US is expected to experience a slowdown, with growth declining from 2.8% in 2024 to 2.0% in 2025 and slightly improving to 2.1% in 2026. This represents a cumulative 0.7 percentage point downward revision compared to earlier projections, primarily due to elevated policy uncertainty, higher trade barriers, and reduced labour force growth.

The euro area shows modest improvement, with growth forecast to rise from 0.9% in 2024 to 1.2% in 2025 and 1.1% in 2026, though this remains well below potential. Germany faces particular challenges with growth of only 0.2% projected for 2025 before recovering to 0.9% in 2026. Japan's growth is expected to accelerate from 0.1% in 2024 to 1.1% in 2025, supported by real wage growth, before moderating to 0.6% in 2026.

Emerging markets and developing economies demonstrate greater resilience, with growth projected to moderate from 4.3% in 2024 to 4.2% in 2025 and 4.0% in 2026. China's growth is forecast at 4.8% in 2025 and 4.2% in 2026, while India maintains stronger momentum with projected growth of 6.6% in 2025 and 6.2% in 2026.

According to the IMF World Economic Outlook (WEO), trade policy uncertainty remains the most significant threat to global growth. Prolonged uncertainty would further weigh on investment decisions and disrupt supply chains, with potential for additional tariff increases creating negative spillovers across economies directly impacted by trade measures. The IMF warns that further escalation could trigger more substantial economic disruptions than currently projected.

Additionally, persistent inflation pressures threaten the disinflationary process, especially in the US where tariff impacts may pass through to consumer prices more significantly than currently anticipated. Rising inflation expectations could force central banks to maintain restrictive policies longer than expected.

Conversely, AI productivity gains represent the primary upside potential, with faster AI adoption potentially unleashing strong productivity growth if accompanied by appropriate regulatory frameworks and labour market programmes. The resolution of trade policy uncertainty through comprehensive agreements could also provide significant economic benefits, with the IMF estimating potential global GDP gains of up to 2% over the long term from returning to lower tariffs and reduced uncertainty.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Ten artykuł jest publikowany wyłącznie w celach informacyjnych i nie powinien być traktowany jako oferta lub zachęta do kupna lub sprzedaży jakichkolwiek inwestycji lub powiązanych usług, do których można się tu odwołać. Obrót instrumentami finansowymi wiąże się ze znacznym ryzykiem strat i może nie być odpowiedni dla wszystkich inwestorów. Wyniki osiągnięte w przeszłości nie są wiarygodnym wskaźnikiem wyników w przyszłości.

Zarejestruj się i otrzymuj informacje rynkowe

Zarejestruj się i otrzymuj

informacje

rynkowe

Subskrybuj teraz