What will Q3 earnings show?

% to 6,654.72

% to $4,108.89 after hitting record of $4,116.77

% to 99.25

What to look out for today

Companies reporting on Tuesday, 14th October: Domino’s Pizza, BlackRock, JPMorgan Chase, Wells Fargo, Citigroup, Goldman Sachs, Johnson & Johnson

Key data to move markets today

EU: German Harmonised Index of Consumer Prices, CPI, ZEW Survey Economic Sentiment and Current Situation, eurozone ZEW Survey Economic Sentiment, and a speech by ECB Executive Board member Piero Cipollone

UK: Claimant Count Change and Rate, Employment Change, ILO Unemployment Rate, Average Earnings (including and excluding bonus), and speeches by BoE Governor Andrew Bailey and BoE External Member Alan Taylor

USA: Speeches by Fed Vice Chair for Supervision Michelle Bowman, Fed Chair Jerome Powell, Fed Governor Christopher Waller, and Boston Fed President Susan Collins and Monthly Budget Statement

GLOBAL: IMF and World Bank Fall Meeting

CHINA: Consumer Price Index and Producer Price Index

US Stock Indices

Dow Jones Industrial Average +1.29%

Nasdaq 100 +2.18%

S&P 500 +1.56%, with 9 of the 11 sectors of the S&P 500 up

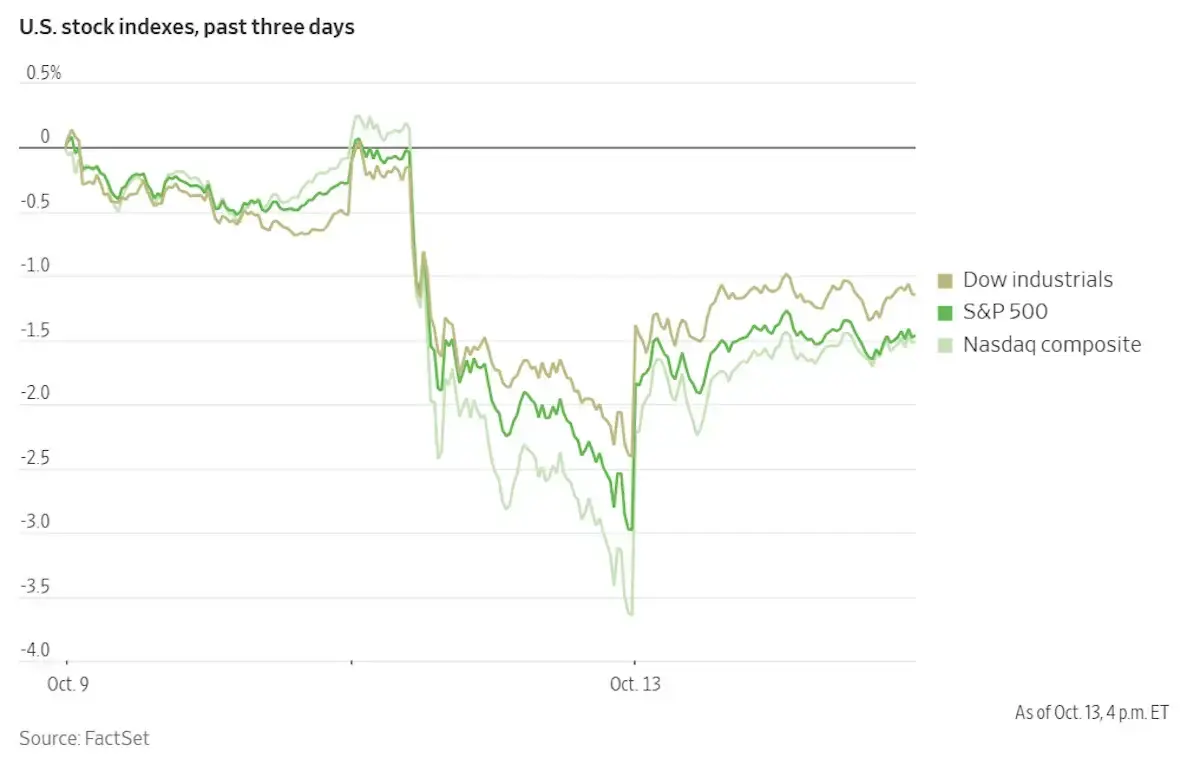

Technology stocks spearheaded a broad-based market recovery on Monday, following reassurances from President Trump and senior administration officials over the weekend that alleviated concerns regarding a potential escalation in the US - China trade dispute.

The Nasdaq Composite and S&P 500 advanced by +2.21% and +1.56%, respectively, marking their strongest performance since May. The Dow Jones Industrial Average gained +1.29%, an increase of 588 points.

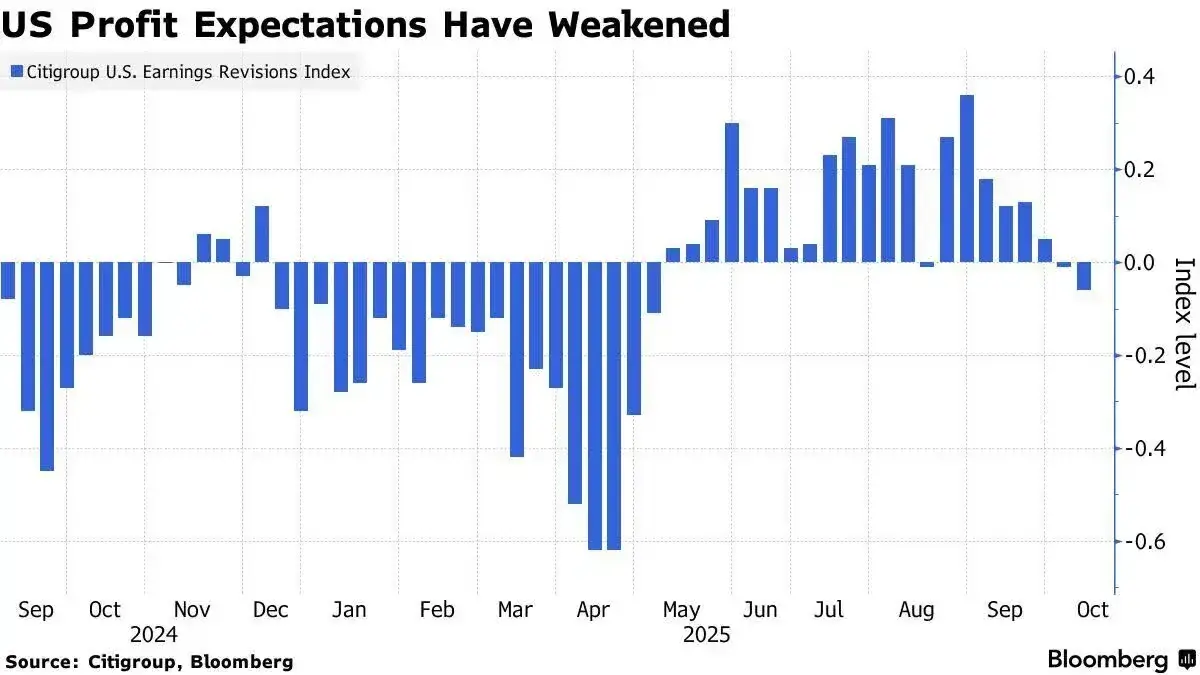

Despite these gains, equity analyst sentiment toward corporate earnings is showing signs of waning momentum at a time when US equities are trading near historic highs. This raises the possibility of increased volatility this earnings season.

A Citigroup index tracking US earnings revisions — which measures the number of analysts raising versus lowering profit forecasts — turned negative for the first time since August. Concurrently, the S&P 500 is trading at one of its highest P/E valuations in the past twenty-five years at 22.4x, leaving limited room for unfavourable developments.

In corporate news, Amazon announced plans to hire 250,000 workers for the upcoming peak season, maintaining the same hiring target as the previous two years. This move distinguishes the online retailer in an otherwise subdued holiday labour market.

Oracle is set to address investor confidence this week as it hosts its four-day AI World conference in Las Vegas, beginning Monday. The event will spotlight Oracle’s cloud computing business and follows a year in which the company’s market value has surged by approximately $370 billion.

Keurig Dr Pepper shares rose after the Financial Times reported that Starboard Value has acquired a stake in the beverage company.

Airbus is expanding its production capacity for the A320neo family, opening additional assembly lines in both the US and China. This initiative aims to achieve a monthly output of 75 jets in response to a significant order backlog.

Virgin Atlantic Airways CEO Shai Weiss will step down following a seven-year tenure, during which he successfully guided the UK airline back to annual profitability.

S&P 500 Best performing sector

Information Technology +2.47%, with Broadcom +9.88%, ON Semiconductor +9.55%, and Monolithic Power Systems +8.54%

S&P 500 Worst performing sector

Consumer Staples -0.36%, with Monster Beverage -3.55%, J M Smucker -3.11%, and Kenvue -2.58%

Mega Caps

Alphabet +3.01%, Amazon +1.71%, Apple +0.97%, Meta Platforms +1.47%, Microsoft +0.60%, Nvidia +2.88%, and Tesla +5.42%

Information Technology

Best performer: Broadcom +9.88%

Worst performer: Arista Networks -4.32%

Materials and Mining

Best performer: Albemarle +7.21%

Worst performer: Avery Dennison -0.74%

European Stock Indices

CAC 40 +0.21%

DAX +0.60%

FTSE 100 +0.16%

Commodities

Gold spot +2.28% to $4,108.89 an ounce

Silver spot +4.12% to $52.34 an ounce

West Texas Intermediate +2.42% to $59.65 a barrel

Brent crude +1.95% to $63.38 a barrel

Gold surpassed $4,100 per ounce for the first time on Monday.

Spot gold rose by +2.28% to $4,108.89 per ounce after hitting an intraday peak of $4,116.77. The market continues to receive structural support from consistent central bank purchases, robust ETF inflows, ongoing US - China trade disputes, and the anticipation of reduced interest rates in the United States.

Oil prices also advanced Monday, after assurances that US President Trump will meet with Chinese President Xi Jinping later in October. This development eased recent trade tensions between the world’s largest economies, which had previously driven crude benchmarks to five-month lows on Friday.

Brent crude futures closed $1.21 higher, or +1.95%, to $63.38 per barrel. US WTI crude futures increased by $1.41, or +2.42%, to $59.65 per barrel. Both benchmarks had declined by over four percentage points on Friday, reaching their lowest levels since May after the US President threatened to cancel the meeting with Chinese President Xi and impose significant new tariffs on Chinese imports.

On the demand side, China's crude oil imports in September climbed 3.9% y/o/y to 11.5 million barrels per day, according to customs data. OPEC maintained its optimistic global oil demand growth forecasts for this year and the next. In its monthly report released on Monday, OPEC indicated that the oil market is expected to experience a far smaller supply deficit in 2026, as the broader OPEC+ alliance continues to increase output.

Meanwhile, prospects for peace in the Middle East moderated oil price gains as the first stage of President Trump’s ceasefire agreement resulted in the release of the final 20 surviving Israeli hostages.

Note: As of 5 pm EDT 13 October 2025

Currencies

EUR -0.40% to $1.1571

GBP -0.22% to $1.3328

Bitcoin +4.14% to $115,811.99

Ethereum +14.00% to $4,262.64

The US dollar appreciated against both the euro and the yen on Monday, following a shift in the US President’s rhetoric that eased ongoing trade tensions with China. The dollar index increased by +0.40% to 99.25.

In Europe, markets largely ignored the announcement of French Prime Minister Sebastien Lecornu’s new cabinet lineup on Sunday, which included the reappointment of Roland Lescure, a close ally of President Emmanuel Macron, as finance minister. The euro weakened by -0.40% to $1.1571, retracing gains made against the dollar in the prior session. Against the safe haven Swiss Franc, the greenback was +0.61% to reach CHF 0.804, marking a recovery from the previous session’s decline.

The British pound slipped -0.22% to $1.3328. BoE policymaker Megan Greene indicated that she is likely to maintain interest rates at their current level until at least March of next year, citing concerns that existing policy may not be sufficiently restrictive to eliminate persistent inflationary pressures.

Greene asserted that there is justification for ‘skipping some rounds in terms of rate cuts,’ emphasising that while the current monetary policy stance remains restrictive, it is less so than in previous periods. She cautioned that the recent sharp increase in prices is influencing inflation expectations. She stressed that, to decisively address inflation, the bank rate should be set at a level significantly more restrictive than the market curve.

The dollar advanced +0.71% to ¥152.22. Trading volumes were lighter due to Japan’s Sports Day holiday. Investors appeared to also be considering the prospects for Japan’s new Liberal Democratic Party leader, Sanae Takaichi, after Komeito’s departure from the ruling coalition on Friday. This has cast uncertainty over her bid to become the country’s first female prime minister.

Fixed Income

US bond markets closed in observance of the Columbus day holiday

German 10-year bund -0.9 basis points to 2.637%

UK 10-year gilt -1.4 basis points to 4.660%

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 98.9% probability of a 25 bps rate cut at October’s FOMC meeting, higher than last week’s 94.1%. Traders are currently anticipating 47.8 bps of cuts by year-end, higher than the 46.1 bps expected last week.

Eurozone government bond yields remained near multi-week lows on Monday. Over the past several days, traders have steadily raised their expectations for future ECB rate cuts. The probability of a 25 bps reduction by July rose to approximately 65%, up from around 45% prior to the US President’s remarks on tariffs and 35% at the beginning of October. The benchmark rate is now projected to reach 1.90% by February 2027, compared to 2.0% at the end of September.

German government bond yields reflected these shifting expectations. The yield on the 10-year Bund declined -0.9 bps to 2.637%, building on Friday’s -5.6 bps drop. Yields on two-year Schatz, particularly sensitive to changes in ECB policy, fell -1.1 bps to 1.949%. At the longer end, the 30-year German yield closed -0.5 bps lower.

The spread between Germany’s safe-haven Bunds and 10-year French government bonds stood at 83.7 bps, down from last week’s peak of 87.9 bps—the highest level recorded since 13th January—driven by concerns regarding France’s fiscal outlook. French Prime Minister Sebastien Lecornu now faces an urgent deadline to form a government by the budget submission date.

Italy’s 10-year yield declined -1.7 bps to 3.438%, narrowing the spread with the German 10-year bund by 1.5 bps to 80.1 bps.

Note: As of 5 pm EDT 13 October 2025

Global Macro Updates

Philly Fed President Paulson sees two cuts this year. In her inaugural address as President of the Philadelphia Fed, Anna Paulson expressed support for two additional 25 bps rate cuts this year. She emphasised that current labour market conditions do not suggest that tariff-induced price increases will lead to persistent inflation. Paulson also cautioned that the foundation underpinning economic growth remains narrow, primarily dependent on consumer spending from higher-income households and capital expenditures related to artificial intelligence.

During the Q&A session, Paulson remarked that the Fed will need to carefully navigate toward the neutral interest rate. She suspects that the breakeven jobs rate may be lower than 75,000 per month. Her comments follow recent indications from other Fed officials who have shown a willingness to consider rate reductions in light of labour market weakness and diminished tariff-related inflation pressures.

Paulson’s remarks precede scheduled appearances today, by Fed Governor Bowman at 8:45 AM ET, Fed Chair Powell at 12:20 PM ET, and Fed Governor Waller at 3:25 PM ET.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Ten artykuł jest publikowany wyłącznie w celach informacyjnych i nie powinien być traktowany jako oferta lub zachęta do kupna lub sprzedaży jakichkolwiek inwestycji lub powiązanych usług, do których można się tu odwołać. Obrót instrumentami finansowymi wiąże się ze znacznym ryzykiem strat i może nie być odpowiedni dla wszystkich inwestorów. Wyniki osiągnięte w przeszłości nie są wiarygodnym wskaźnikiem wyników w przyszłości.

Zarejestruj się i otrzymuj informacje rynkowe

Zarejestruj się i otrzymuj

informacje

rynkowe

Subskrybuj teraz