How long will the shutdown last?

% to 6,688.46

% to $3,860.25, after hitting a record high of $3,871.45

Key data to move markets today

EU: Eurozone, Spanish, French, German and Italian HCOB Manufacturing PMIs, Eurozone Harmonised Index of Consumer Prices and Core Harmonised Index of Consumer Prices and speeches by ECB Executive Board member Frank Elderson and ECB Vice President Luis de Guindos

UK: Speech by BoE Deputy Governor Catherine Mann

USA: ADP Employment, ISM Manufacturing PMI, ISM Manufacturing Prices Paid, ISM Employment Index, and ISM New Orders Index

US Stock Indices

Dow Jones Industrial Average +0.18%

Nasdaq 100 +0.28%

S&P 500 +0.41%, with 7 of the 11 sectors of the S&P 500 up

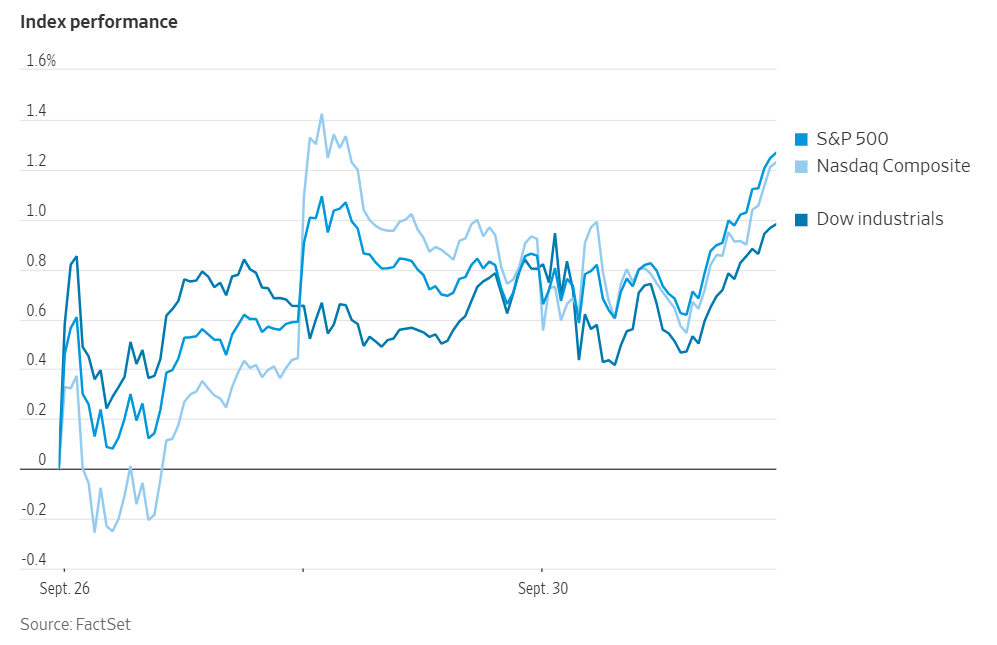

US equity markets ended the day with modest gains, capping off a historically strong month. The S&P 500 was +0.41% higher after oscillating between small gains and losses for several hours. This advance secured the index's best September performance in 15 years, a rally fuelled by sustained optimism over AI and the prospect of lower interest rates.

In parallel, the Dow Jones Industrial Average was +0.18% to establish a new all-time high, while the Nasdaq Composite gained +0.30%.

On the corporate news, Berkshire Hathaway is reportedly finalising a transaction valued at nearly $10 billion to acquire Occidental Petroleum's petrochemical business.

BlackRock's Global Infrastructure Partners is nearing a $38 billion agreement to acquire the utility group AES.

An agreement was announced between the Trump administration and Pfizer with the goal of lowering drug prices for Medicaid recipients.

Nike reported quarterly results that beat analyst expectations on both revenue and profit. However, the company issued a cautious forecast, warning of a challenging sales outlook for the holiday season and the impact of costlier tariffs.

The Department of Energy announced its intention to acquire a 5% stake in Lithium Americas, along with a separate interest in the company's lithium mine joint venture with General Motors.

Ford’s CEO projected that electric vehicle sales could be cut in half once federal tax credits expire.

S&P 500 Best performing sector

Health Care +2.45%, with Pfizer +6.83%, Merck & Co +6.81%, and Danaher +6.56%

S&P 500 Worst performing sector

Energy -1.07%, with Baker Hughes -3.62%, Schlumberger -2.11%, and Marathon Petroleum -1.90%

Mega Caps

Alphabet -0.33%, Amazon -1.17%, Apple +0.08%, Meta Platforms -1.21%, Microsoft +0.65%, Nvidia +2.59%, and Tesla +0.34%

Information Technology

Best performer: Dell Technologies +5.88%

Worst performer: GoDaddy -3.42%

Materials and Mining

Best performer: Freeport-McMoRan +5.66%

Worst performer: Albemarle -6.68%

European Stock Indices

CAC 40 +0.19%

DAX +0.57%

FTSE 100 +0.54%

As of 30th September, according to LSEG I/B/E/S data, for the STOXX 600, Q2 2025 earnings are expected to increase 4.0% from Q2 2024. Excluding the Energy sector, earnings are expected to increase 7.6%. Q2 2025 revenue is expected to decrease 1.7% from Q2 2024. Excluding the Energy sector, revenues are expected to increase 0.5%. Of the 287 companies in the STOXX 600 that have reported earnings by 30th September for Q2 2025, 50.5% reported results exceeding analyst estimates. In a typical quarter 54% beat analyst EPS estimates. Of the 356 companies in the STOXX 600 that have reported revenue for Q2 2025, 49.7% reported revenue exceeding analyst estimates. In a typical quarter 58% beat analyst revenue estimates.

Financials is the sector with most companies reporting above estimates at 67%. Financials, with a surprise factor of 12.1%, is the sector that beat earnings expectations by the highest surprise factor. In the Basic Materials sector, 73% of companies have reported below estimates. Its earnings surprise factor was the lowest at -13.2%. The STOXX 600 surprise factor is 5.4%, which is below the long-term (since 2012) average surprise factor of 5.8%. The forward four-quarter price-to-earnings ratio (P/E) for the STOXX 600 sits at 14.5x, slightly above the 10-year average of 14.2x.

During the week of 6th October, one company is scheduled to report Q2 earnings.

Commodities

Gold spot +0.74% to $3,860.25 an ounce

Silver spot -0.55% to $46.67 an ounce

West Texas Intermediate -1.03% to $62.48 a barrel

Brent crude -0.87% to $67.06 a barrel

Gold prices advanced on Tuesday, approaching record highs as mounting concerns about a potential US government shutdown supported demand.

Spot gold was +0.74% to $3,860.25 per ounce, recovering from earlier declines during US trading hours. The metal reached an all-time high of $3,871.45 in Asian trading.

Gold was +12.0% in September, the largest monthly percentage gain since August 2011.

Oil prices declined on Tuesday, as investors anticipated a supply surplus stemming from a possible substantial output increase next month from OPEC+ and the resumption of oil exports from Iraq's Kurdistan region via Turkey.

Brent crude futures for November delivery, which expired on Tuesday, closed 59 cents lower, or -0.87%, at $67.06 per barrel. The more actively traded December contract settled at $66.03 per barrel.

US WTI crude ended the session down $0.65 or -1.03% to $62.48 per barrel.

OPEC+ may consider accelerating production increases for November at its meeting on Sunday. According to a Reuters report, Saudi Arabia is advocating for a more substantial hike to reclaim market share. Eight OPEC+ members could agree to boost production in November by 274,000 to 411,000 bpd, which is two to three times higher than the October increase. Bloomberg news indicated that production increases could reach up to 500,000 bpd.

On Saturday, crude oil began flowing through a pipeline from the semi-autonomous Kurdistan region in northern Iraq to Turkey for the first time in two and a half years, following an interim agreement that resolved a longstanding impasse, according to Iraq's oil ministry.

The market has remained cautious in recent weeks, weighing ongoing supply risks—primarily linked to Ukraine's drone attacks on Russian refineries—against expectations of oversupply and subdued demand. Additionally, US crude production reached a new monthly high in July, rising by 109,000 bpd from June to 13.64 million bpd, as reported by the Energy Information Administration on Tuesday.

Note: As of 5 pm EDT 30 September 2025

Currencies

EUR +0.08% to $1.1735

GBP +0.16% to $1.3443

Bitcoin -0.08% to $114,190.41

Ethereum -1.69% to $4,154.92

The US dollar declined on Tuesday after weaker than expected economic data.

Both the US Labor and Commerce departments announced that, in the event of a partial government shutdown, their statistical agencies would suspend data releases. This suspension would include key reports like the September nonfarm payroll data scheduled for Friday.

During afternoon trading, the dollar fell following a mixed Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics. The report indicated that job openings in the US rose modestly in August, increasing by 19,000 to 7.227 million as of the last day of the month, while hiring fell by 114,000 to 5.126 million. Layoffs decreased by 62,000 to 1.725 million, reflecting a labour market that continues to soften.

The dollar index slipped by -0.15% to 97.79, resulting in a modest decline of -0.06% for the month of September. Meanwhile, the euro was +0.08% to $1.1735, ending the month +0.44% higher. The dollar came under further pressure from a drop in US consumer confidence, which fell 3.6 points to 94.2 for the month, below economists’ expectations of a decline to 96.0.

The dollar weakened -0.48% against the yen, reaching ¥147.84. Investors evaluated BoJ’s summary of opinions from its September meeting, where the possibility of a near-term rate hike was discussed. Market data suggests traders are assigning a 60% probability to a rate increase in December. The dollar advanced 0.56% against the yen over the course of September.

The British pound remained resilient despite data showing UK economic growth slowed to 0.3% in the second quarter. The current account deficit widened more than expected, reaching 3.8% of GDP in Q2, up from 2.8% in Q1. Sterling gained +0.16% against the dollar to trade at $1.3443. It edged slightly higher against the euro, which fell -0.20% to 87.28 pence.

Fixed Income

US 10-year Treasury +0.8 basis points to 4.152%

German 10-year bund +0.4 basis points to 2.716%

UK 10-year gilt -0.5 basis points to 4.700%

On Tuesday, US Treasury yields displayed a mixed performance as some investors sought the safety of government securities amid mounting political uncertainty and threat of a government shutdown. Analysts have noted that the risk of a prolonged shutdown may negatively affect economic growth in the fourth quarter.

The 10-year Treasury note pared losses from early trading and ultimately closed +0.8 bps to 4.152%. Meanwhile, two-year yield—which is more sensitive to expectations regarding interest rate changes — was -1.2 bps to 3.617%. At the longer end, the 30-year yield advanced +2.2 bps to 4.730%.

For the month of September, the 10-year yield decreased by -8.1 bps, the two-year yield dropped by -0.8 bps, and the 30-year yield declined by -19.9 bps.

In addition, the spread between the two- and 10-year yields narrowed by 7.3 bps to 53.5 bps over the month, while the spread between the two- and 30-year yields contracted by 19.1 bps to 130.4 bps.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 96.7% probability of a 25 bps rate cut at October’s FOMC meeting, higher than last week’s 91.9%. Traders are currently anticipating 68.8 bps of cuts by year-end, slightly lower than the 68.7 bps expected last week.

Across the Atlantic, Germany’s 10-year Bund yield edged higher by +0.4 bps to reach 2.716%.

Market participants have factored in approximately a 35% probability of a 25 bps rate cut by the ECB by July. Projections indicate the key rate could be around 1.98% in February 2027, down from the current 2.0%.

German 2-year yields, particularly responsive to expectations of ECB policy, remained largely stable, rising just +0.2 bps to 2.033%. At the long end of the curve, the 30-year Bund yield fell by -1.0 bps, closing at 3.284%.

Bund yields saw their first monthly decline since April. For the month of September, the 10-year Bund yield declined -1.1 bps, the 2-year yield increased +8.2 bps, and the 30-year yield decreased -5.3 bps. The spread between the 2-year and 10-year yields narrowed by 9.3 bps to 68.3 bps, while the spread between the 2-year and 30-year yields contracted by 13.5 bps to 125.1 bps.

The ongoing reform of the Dutch pension system is expected to cause reduced demand from pension funds for ultra-long-dated bonds.

The yield spread between German Bunds and 10-year French government bonds stood at 82.5 bps, as the French 10-year yield increased +0.2 bps on Tuesday, finishing the month +2.7 bps higher at 3.541%. France’s new Prime Minister, Sebastien Lecornu, stated his objective to achieve a budget deficit of approximately 4.7% of GDP in 2026, which is only marginally higher than Bayrou's target of 4.6%, and down from a projected 5.4% this year.

Italy’s 10-year yield rose +0.8 bps on Tuesday to 3.545%, maintaining a spread over the 10-year Bund yield at 82.9 bps. This spread narrowed by 4.2 bps during September.

Note: As of 5 pm EDT 30 September 2025

Global Macro Updates

US government shutdown begins. The US government officially began to shut down after a midnight deadline to pass new funding expired on 1st October. This occurred after last-minute attempts to avert the impasse failed on Tuesday, with the Senate rejecting competing stopgap funding measures.

A major area of contention remains the Affordable Care Act subsidies that are scheduled to expire on 1st January. While Republicans, and reportedly President Trump, have suggested these could be discussed, they have been firm that such negotiations should not be part of a temporary funding bill.

Despite the political gridlock, the market has shown little concern so far, likely because past shutdowns have typically been short-lived. A more immediate issue, however, is the potential delay in the release of key economic data, most notably Friday's highly anticipated September nonfarm payrolls report.

There is also significant uncertainty surrounding the fate of government employees. The Congressional Budget Office (CBO) estimates that a shutdown could furlough approximately 750,000 workers each day, representing a loss of roughly $400 million in daily compensation. Adding to this tension, The New York Times reported that President Trump stated on Tuesday that ‘a lot of good’ could come from a shutdown, threatening mass layoffs of federal employees and the defunding of programmes aligned with Democrats.

Labour market shows stability, but cracks appear. The August JOLTS report indicated that job openings unexpectedly rose to 7.227 million, surpassing the consensus forecast of 7.100 million and ticking up from July's revised figure. While the overall rate of job openings held steady at 4.3%, the report revealed decreases in the construction and federal government sectors.

Other key labour metrics, such as the hire and separations rates, were largely unchanged. However, the quit rate, a key indicator of worker confidence, dipped from 2.0% to 1.9%, its lowest level since last December, hinting at growing caution among employees.

This hint of eroding confidence was much more pronounced in the September consumer confidence report, which fell to 94.2 from August’s 97.8.

The drop was largely driven by a shifting perception of the job market. The percentage of consumers calling jobs ‘plentiful’ fell from 30.2% to 26.9%. This souring mood was reflected in the result of the Present Situation Index. It came in at 125.4, significantly down from August’s 132.4 reading. This was the largest drop in a year. The Expectations Index also edged lower to 73.4 from 74.7.

Further evidence of a slowdown came from the manufacturing sector. The September Chicago Fed PMI missed forecasts, falling to 40.6 from 41.5 in August, indicating a deeper contraction. The report's details were particularly concerning: new orders dropped significantly, and the employment component eased to its lowest reading since June 2009. This signals a pullback in factory hiring. On a slightly brighter note, the Prices Paid component moderated, suggesting some easing of inflationary pressures.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Ten artykuł jest publikowany wyłącznie w celach informacyjnych i nie powinien być traktowany jako oferta lub zachęta do kupna lub sprzedaży jakichkolwiek inwestycji lub powiązanych usług, do których można się tu odwołać. Obrót instrumentami finansowymi wiąże się ze znacznym ryzykiem strat i może nie być odpowiedni dla wszystkich inwestorów. Wyniki osiągnięte w przeszłości nie są wiarygodnym wskaźnikiem wyników w przyszłości.

Zarejestruj się i otrzymuj informacje rynkowe

Zarejestruj się i otrzymuj

informacje

rynkowe

Subskrybuj teraz