Will it be a slow drip or a sudden drop?

Key data to move markets today

EU: German Factory Orders, Eurozone Employment Change, and Eurozone GDP.

UK: Retail Sales.

US: Nonfarm Payrolls, Unemployment Rate, Labour Force Participation Rate, Average Weekly Hours, Average Hourly Earnings, and U6 Unemployment Rate.

US Stock Indices

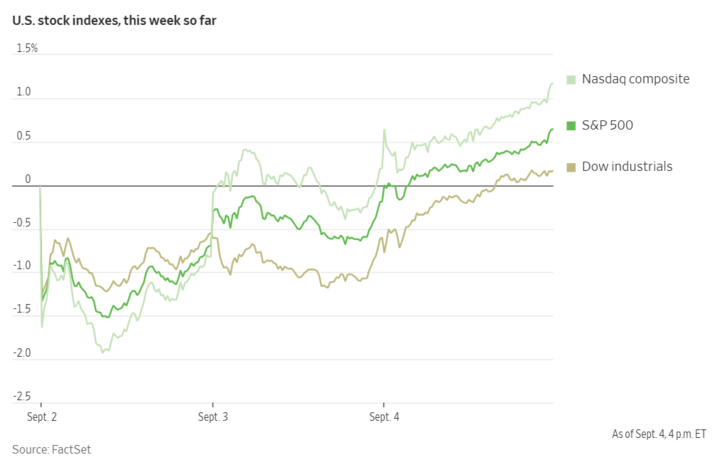

Dow Jones Industrial Average +0.77 %.

Nasdaq 100 +0.93 %.

S&P 500 +0.83 %, with 10 of the 11 sectors of the S&P 500 up.

The S&P 500 hit another record high on Thursday, rising +0.83% or 53.87 points to 6,502.08, while the Nasdaq Composite was +0.98% or 209.97 points to 21,707.69, and the Dow Jones Industrial Average was +0.77% or 350.06 points to 45,621.29.

In corporate news, apparel company American Eagle Outfitters shares surged 38% after it forecast third-quarter comparable sales above estimates on Wednesday.

JetBlue Airways is set to partner with Amazon subsidiary Project Kuiper, a low Earth orbit satellite broadband internet network, to improve its onboard Wi-Fi.

According to Bloomberg news, OpenAI plans to launch a new AI-powered jobs platform next year to help match employers with candidates who have artificial intelligence skills in a bid to accelerate the technology’s deployment across businesses and government agencies.

Boeing said it plans to start hiring permanent replacements for some of the 3,200 hourly workers on strike at its St Louis defence hub; there is no break in sight for the one-month-old labour dispute.

General Motors is cutting output at one of its main electric-vehicle factories and will only start the launch of the Chevrolet Bolt electric vehicle in December with only one shift at its plant in Kansas. It is the latest automaker to pull back on EVs as President Trump's administration removes federal support for green cars.

S&P 500 Best performing sector

Consumer Discretionary +2.25%, with Williams-Sonoma +5.61 %, Builders FirstSource +5.09 %, and Amazon +4.29 %.

S&P 500 Worst performing sector

Utilities -0.16%, with NiSource -4.71%, AES -3.17%, and American Electric Power Company -1.26%.

Mega Caps

Alphabet +0.71%, Amazon +4.29%, Apple +0.55 %, Meta Platforms +1.57%, Microsoft +0.52%, Nvidia +0.61 %, and Tesla +1.33 %.

Information Technology

Best performer: Western Digital +5.34 %.

Worst performer: Salesforce -4.85%.

Materials and Mining

Best performer: Packaging Corp. of America +1.78 %.

Worst performer: Smurfitt WestRock -1.66%.

European Stock Indices

CAC 40 -0.27%.

DAX +0.74%.

FTSE 100 +0.42%.

Commodities

Gold spot -0.25% to $3,555.16 an ounce.

Silver spot -1.78% to $41.31 an ounce.

West Texas Intermediate -0.8% to $63.48 a barrel.

Brent crude -1.0% to $66.95 a barrel.

Gold fell slightly on Thursday as traders took profits following a recordbreaking rally, with investors looking to today’s nonfarm payrolls report for further indications of the Federal Reserve’s policy path.

Spot gold was -0.25% to $3,555.16 per ounce. Spot gold prices had hit a record high of $3,578.50 on Wednesday.

Oil prices fell on Thursday in anticipation of a meeting of 8 OPEC+ members on Sunday when they will consider further increases to production in October. A potential OPEC+ production hike would send a strong signal that regaining market share takes priority over price support. OPEC+ has already agreed to raise output targets by about 2.2 million barrels per day from April to September, in addition to a 300,000-bpd quota increase for the United Arab Emirates.

Brent crude was down 65 cents or -1.0%, to $66.95 a barrel, the lowest close since 20 August. WTI crude closed 49 cents, or -0.8%, to settle at $63.48 a barrel. Oil declined on concerns that OPEC+ will once again bolster supply at a meeting on Sunday, compounding fears of higher volumes later in the year.

EIA Weekly report. In its weekly report, delayed a day due to the US Labor Day holiday on Monday, the US Energy Information Administration (EIA) said US crude oil refinery inputs averaged 16.9 million barrels per day during the week ending 29 August, which was 11 thousand barrels per day less than the previous week’s average.

Gasoline production decreased last week, averaging 9.9 million barrels per day. Distillate fuel production increased by 36 thousand barrels per day last week, averaging 5.3 million barrels per day.

US crude oil imports averaged 6.7 million barrels per day last week, increased by 508 thousand barrels per day from the previous week.

US commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.4 million barrels from the week ended 29 August as refineries head into maintenance season. Stockpiles at the storage hub at Cushing, Oklahoma, increased to the highest since early May. At 420.7 million barrels, US crude oil inventories are about 4% below the five year average for this time of year.

Note: As of 5 pm EDT 4 September 2025

Currencies

EUR -0.09% to $1.1651.

GBP -0.06% to $1.3435.

Bitcoin -1.17% to $110,450.00.

Ethereum -3.24% to $4,307.70.

The US dollar rose slightly on Thursday as weakening jobs data reinforced expectations of a rate cut later this month and traders appeared wary of making any

big moves ahead of today’s more comprehensive non-farm payrolls report. The US dollar index was +0.13% to 98.27.

The British edged down -0.06% to $1.3435. The euro also slipped against the US dollar, -0.09% to $1.1651.

The dollar edged up +0.25% against the Japanese yen, reaching ¥148.48.

Fixed Income

US 10-year Treasury -5.5 basis points to 4.161%.

German 10-year bund -2.1 basis points to 2.722%.

UK 10-year gilt -2.4 basis points to 4.725%.

Yields fell on Thursday after ADP reported lower-than-expected new jobs in August and weekly jobless claims climbed more than forecast. This softer data along with comments by New York Fed President John Williams that his forecast is that it will “become appropriate” to cut interest rates “over time,” reinforced expectations of a rate cut by the Fed later this month.

The 10-year yield hit its lowest since April, falling -5.5 bps to 4.167%. The two-year yield also fell -2.4 bps to 3.589%. It slid to a four-month low of 3.588% earlier in the session. The US 30-year bond yield was -4.3 bps to 4.856%. The Treasury yield curve flattened for a second straight day, with the gap between two-year and 10-year yields narrowing to around 58 bps compared with 59.6 bps late on Wednesday.

Fed funds futures traders are now pricing in a 97.3% probability of a rate cut this month, up from 86.7% last week, according to CME Group's FedWatch Tool. Traders are currently anticipating bps of cuts by year-end, higher than the bps expected last week.

Across the Atlantic, the UK’s 30-year yield fell -3 bps to 5.58%, and the 10-year UK gilt yield was -2.4 bps to 4.725%.

Eurozone government bond yields also fell on Thursday, after rising earlier this week, as weak US data and remarks from Fed policymakers reinforced bets of a rate cut later this month. The German 10-year bond yield was -2.1 bps to 2.722%. At the longer end, the 30-year German bund yield fell -1.3 bps to 3.34%. It had hit 3.434% on Wednesday, the highest in over 14 years.

The yield spread between perceived ‘safe-haven’ German Bunds and 10-year French government bonds was 80 bps, after having reached 82.0 bps last week. France's 30-year yield was down 4.3 bps at 4.40%. It hit 4.523% on Tuesday, the highest since June 2009. French Finance Minister Eric Lombard said the government would have to compromise on plans to cut the budget deficit if Prime Minister François Bayrou loses the confidence vote on 8 September and the government collapses.

Italy’s 10-year yield was -3.4 bps to 3.581%. Italy's Treasury said on Tuesday it raised 5 billion euros through a new 30-year BTP, after attracting around 107 billion euros in total orders. Italy's 30-year yield fell 3.4 bps to 4.58%.

Note: As of 5 pm EDT 4 September 2025

Global Macro Updates

More signs of weakening in the US labour market. US private payrolls increased less than expected in August, while weekly jobless claims came in higher than expected. ADP data showed that private payrolls increased by only 54,000, roughly half the pace of the previous month.

Weekly jobless claims increased 8,000 to 237,000 for the week ended 30 August according to the US Labor Department, while continuing claims fell 4,000 to 1.940 million during the week ending 23 August.

The weakening labour market will support a Fed cut later this month although much still depends on August’s nonfarm payroll report, due later today, and CPI data due next week. Employment gains averaged 35,000 jobs per month over the three months to July compared to 123,000 during the same period in 2024, the government reported in August. The unemployment rate is forecast to climb to 4.3% from 4.2% in July.

Expectations for today’s nonfarm payroll report are that it grew around 75,000 in August. If this is the case, it would mark a fourth straight month of job growth below 100,000. The unemployment rate is also expected to have risen from 4.2% to 4.3% — the highest level since 2021. The main concern around the nonfarm payroll number is that if it is worse than expected, ie, a quicker deceleration, then the market is likely to become more concerned about the Fed being behind the curve, with the associated risks of stagflation this implies.

Fed independence may still be an issue. On Thursday, President Trump’s nominee to the Federal Reserve Board, his current head of the Council of Economic Advisers, Stephen Miran, when challenged about how he would balance his political allegiance to President Trump with the duties of Fed governor, told the Senate banking committee that although he viewed Fed independence as “paramount” and a critical element for its success, that “the president is entitled to a view on appropriate monetary policy, as is everyone else interested in the subject”. He has been selected by President Trump to temporarily replace Adriana Kugler, whose term expires in January.

Concerns around Fed independence have grown after President Trump took the unprecedented step of firing Fed governor Lisa Cook over allegations of mortgage fraud. She has denied the allegations and is contesting the dismissal. However, as noted by the Financial Times, the US Department of Justice has opened a criminal investigation into her behaviour, according to a person familiar with the matter. The president has also repeatedly criticised Fed chair Jay Powell for refusing to lower interest rates and has also discussed removing him as well.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Ten artykuł jest publikowany wyłącznie w celach informacyjnych i nie powinien być traktowany jako oferta lub zachęta do kupna lub sprzedaży jakichkolwiek inwestycji lub powiązanych usług, do których można się tu odwołać. Obrót instrumentami finansowymi wiąże się ze znacznym ryzykiem strat i może nie być odpowiedni dla wszystkich inwestorów. Wyniki osiągnięte w przeszłości nie są wiarygodnym wskaźnikiem wyników w przyszłości.

Zarejestruj się i otrzymuj informacje rynkowe

Zarejestruj się i otrzymuj

informacje

rynkowe

Subskrybuj teraz